Elective Procedures After COVID-19: How To Support Rebounding Demand

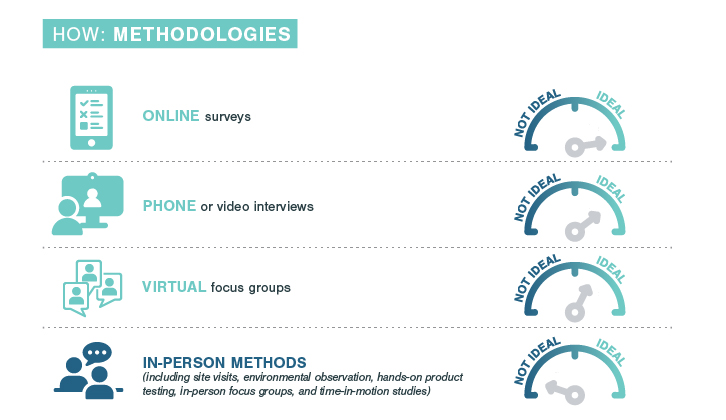

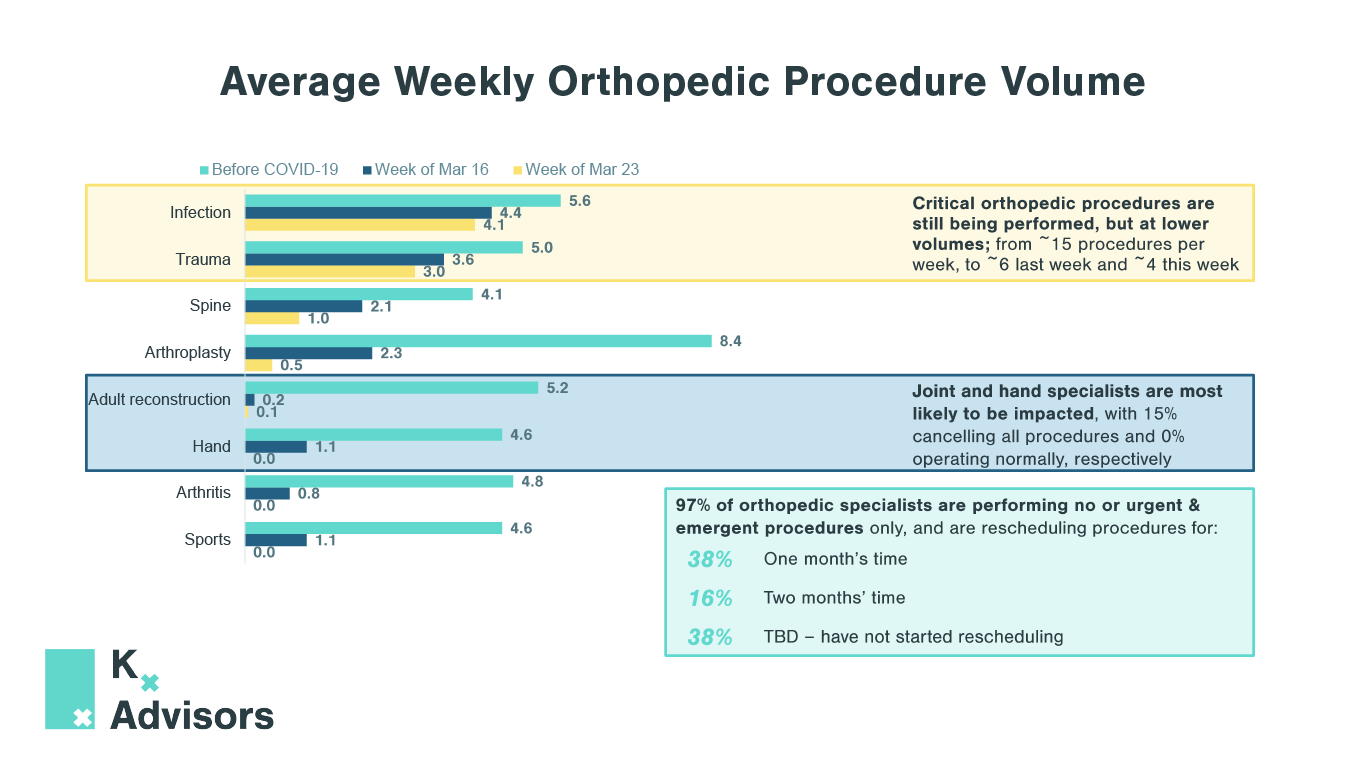

Due to COVID-19, pharmaceutical and medical device organizations face unprecedented obstacles, impacting product forecasting, pipelines, and overall corporate strategy. One major business challenge created by this pandemic is the policy-driven limitation on elective procedures, resulting in restricted healthcare provider (HCP) accessibility for patients. Approximately 27% of patients experienced an elective procedure delay or cancelation due to COVID-19, according to an April 13th poll of over 2,500 US adults.

Defining Elective and Essential Procedures

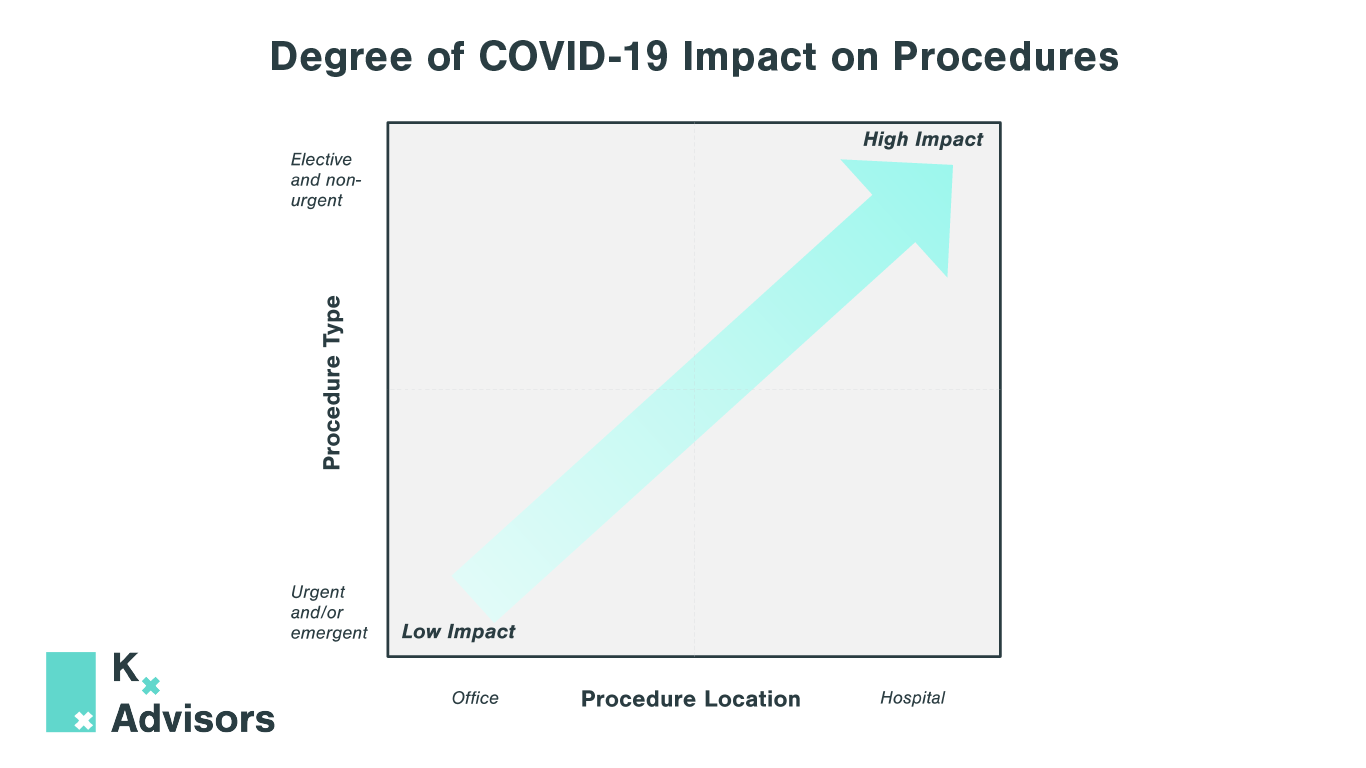

There is no single definition of elective procedure, and the meaning of the term varies across the globe and from person to person, given how HCPs and patients view the urgency of medical situations. Generally, an elective procedure is recognized as a non-urgent procedure that can be scheduled in advance. The term elective procedure may be associated with non-immediately life-saving procedures; however, examples of necessary elective procedures include cancer surgeries, kidney stone removal, mental health services, and joint replacements.

The Impact of Pandemic Restrictions

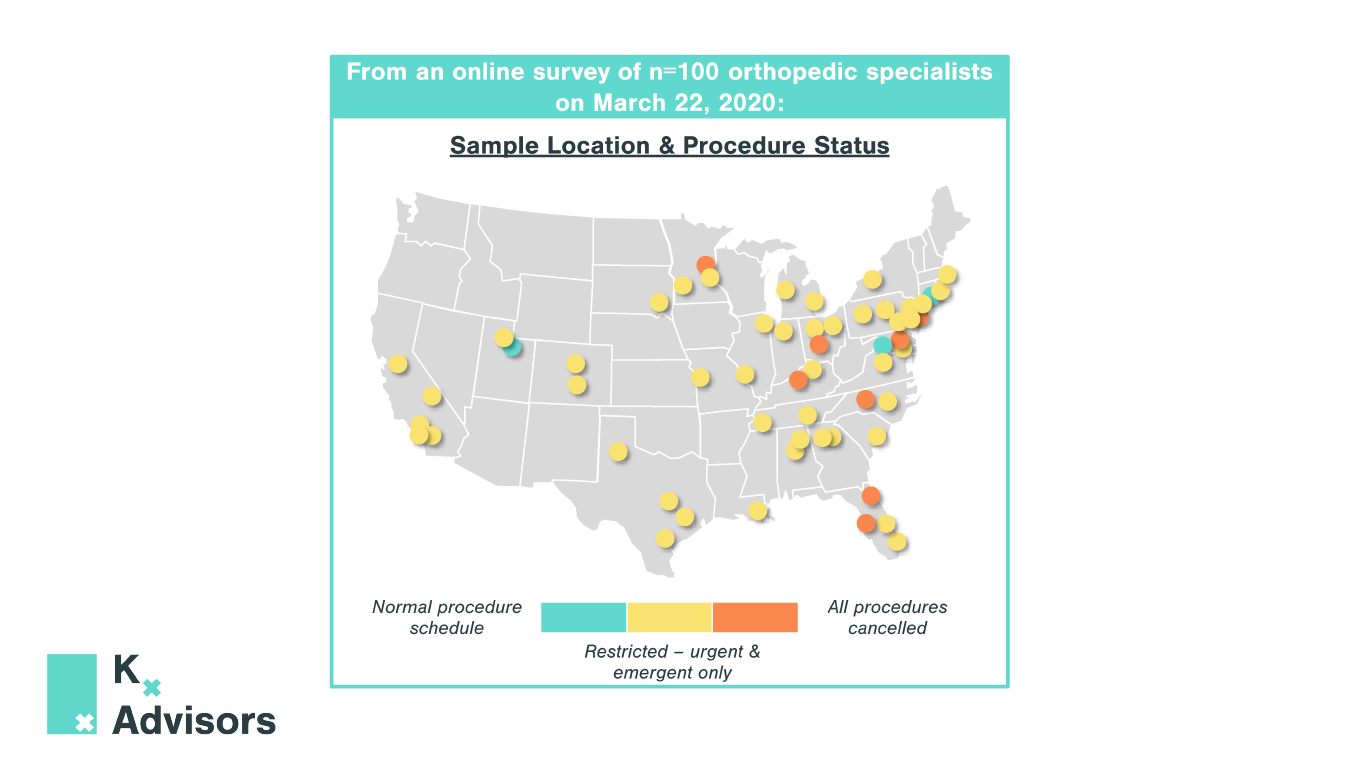

The impact on individual hospitals and the procedures they perform is dependent on their location, the severity of the pandemic there, and how different regions are managing the epidemic. While some hospitals are fully operational, others have been prioritizing COVID-19 patients and chose, or were legislated, to scale back on elective procedures.

We are beginning to see a rebound in hospital visits and elective procedures performed in COVID-impacted areas. There is evidence that hospital visit declines in the US may have bottomed out, with a 4% increase in outpatient hospital visits in the second week of April marking the first increase in visit volume since early March. As lockdown measures are relaxed, the re-introduction of elective procedures may take some time. The pandemic has increased anxiety about seeking treatment, keeping patients from going to hospitals. Emergency room visits are down by about 50% across New York City Health and Hospital locations. This fear could take time to subside and impact patient behavior for longer than policy measures restrict procedures.

The evolution of elective procedures will be region-dependent, as strategies to lift lockdown measures and priorities are decided at a national or regional level. As the pandemic continues and cases decrease, nations are facing the challenging decision of whether to prioritize certain elective procedures, and if so, which elective procedures to bring back first. In the United Kingdom, mental health and cancer surgeries are being prioritized amongst elective procedures. However, as we see demand rise again for specific products or procedures, this resurgence will likely result in a backlog of procedures. This backlog will have a direct impact on other procedures. For example, we may see a surge of cancer surgeries that were delayed by pandemic mitigation measures, resulting in less available operating room space and limited opportunities for other operations.

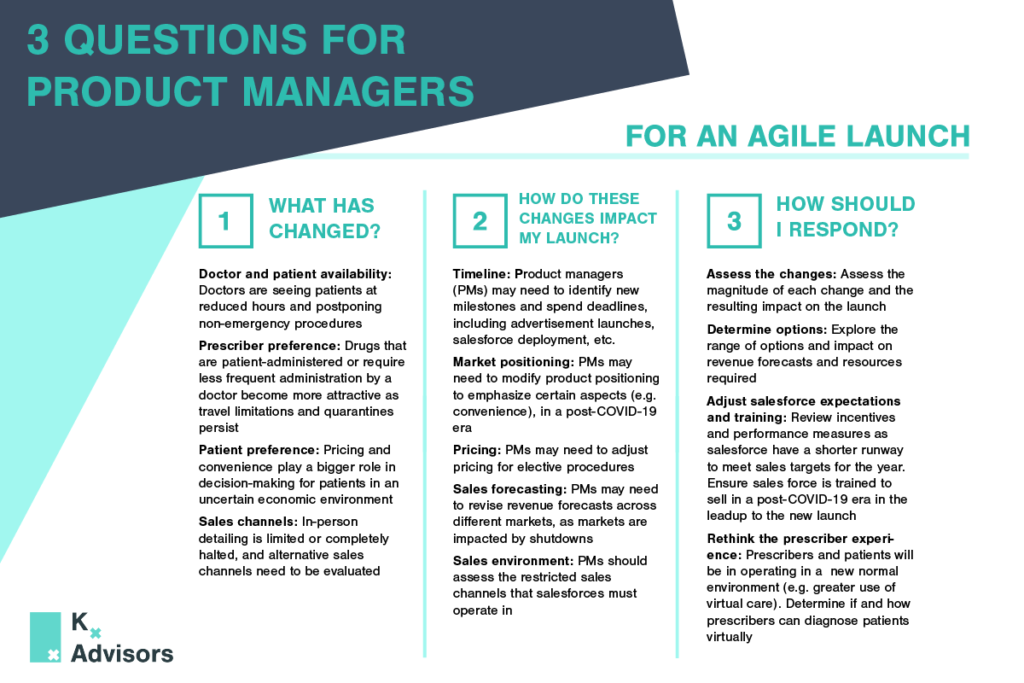

Preparing For Procedures Now And Post-COVID-19

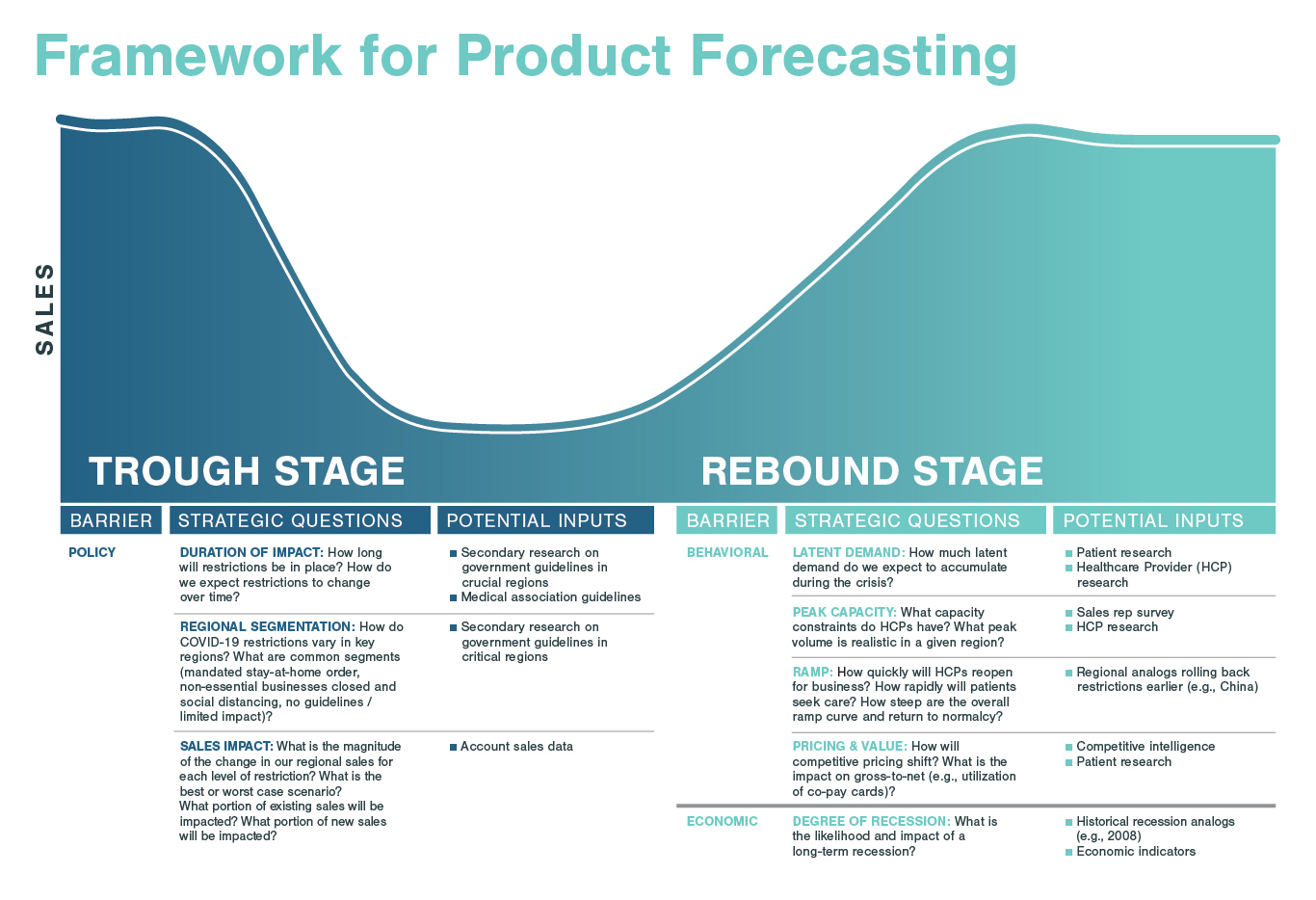

With the rollback of lockdown measures and changes on the horizon for elective procedures, healthcare organizations can support HCPs and patients in new ways. There are several factors procedure-focused companies must consider as they face the pandemic’s challenges now and throughout the global recovery:

- Map demand and prepare for the backlog: Companies must monitor changes in government regulations, medical association guidance, and access to personal protective equipment (PPE), as well as analyze the continuing evolution of COVID-19 to determine which products can meet demand in identified places at the correct time. Part of this calculation must include a backlog in regions that begin to allow elective procedures. With this expected backlog of elective procedures, companies must ensure they are ready to support HCPs and patients to ensure a smooth ramp up.

- Explore new ways to aid HCPs performing procedures: Crafting specialized product protocols, creating guidance for performing specific procedures more safely, and providing PPE where appropriate can support HCPs as they adapt. HCP accessibility and increased demand could also have implications for field team deployment. While it may now be more appropriate for field teams to actively reach out to HCPs, COVID-19 safety concerns may intensify scrutiny on sales rep involvement in surgeries. Understanding the changing landscape will be key for healthcare companies during this rebound phase.

- Devise additional ways to help patients: With the looming fear of exposure to COVID-19 while in care settings for procedures, pharmaceutical and medical device companies can support HCPs’ new protocols to keep patients safe during procedures. From reinforcing safety of minimally invasive procedures in outpatient clinics rather than hospitals, to crafting additional guidelines for keeping medical devices uncontaminated, companies can provide value in new ways.

How Kx Advisors Can Help

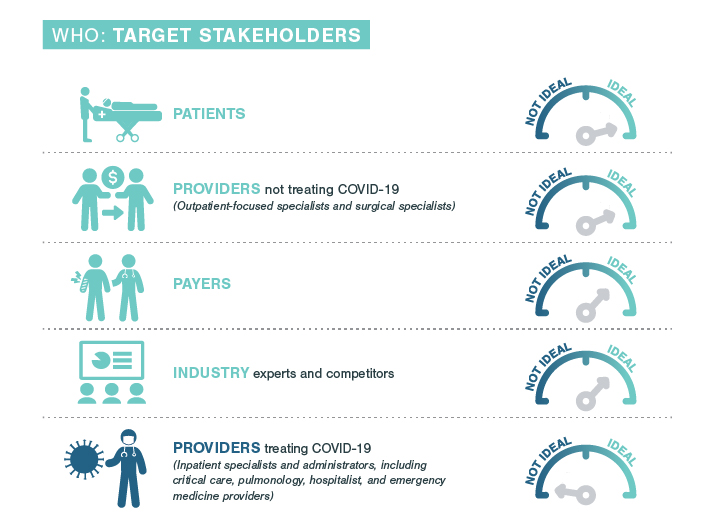

Kx Advisors is continuing to evaluate business models, deliver top-notch expertise, and make profitable recommendations to our healthcare clients. Our team of experts can help your organization assess demand during and after COVID-19 and adapt your corporate strategy to position you for long-term success.