AN ORPHAN DRUGS JOURNEY: COMMERCIALIZING RARE DISEASE DRUGS

In this series, Kaiser will explore how rare disease drug companies can develop commercial growth strategies to succeed against the challenges of a high cost and highly specialized market.

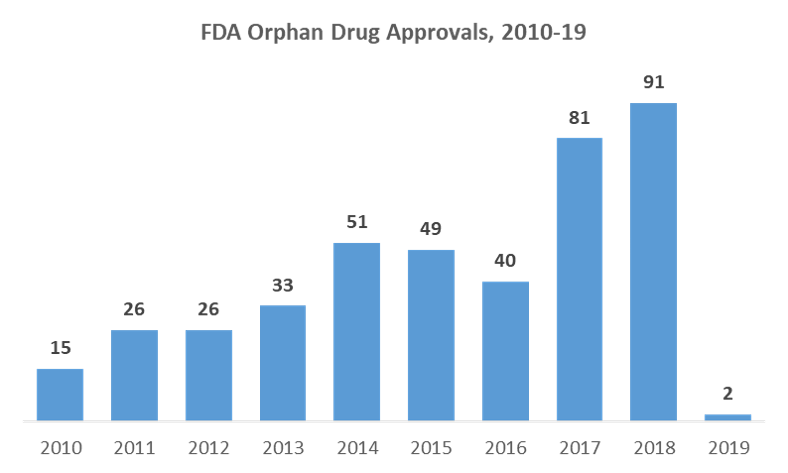

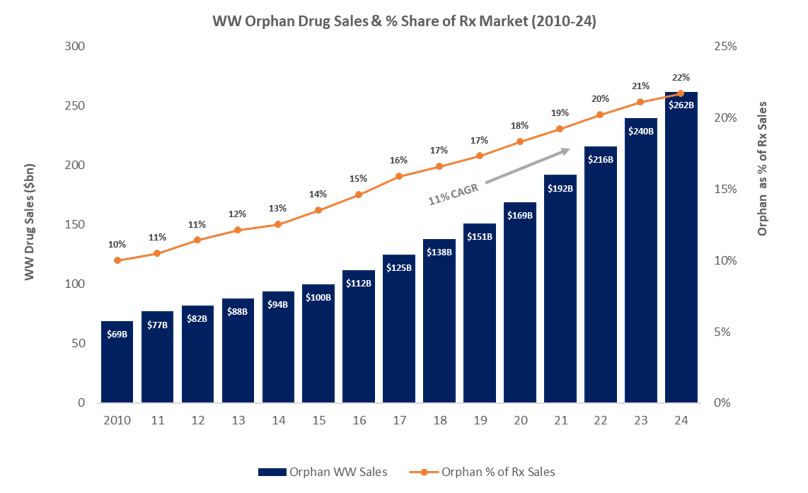

2018 saw 91 orphan drug approvals by the FDA – nearly 3 times greater than in 2013 and the highest number of approvals yet – along with over 400 designations for the candidates in development. 2019 is expected to bring even more orphan drug approvals as more companies begin to realize R&D investments in rare diseases. Driven by high pricing potential, significant unmet needs, and favorable regulatory policy, orphan drug sales are expected to balloon to reach $262B in the next 5 years. The market continues to grow more competitive and new technologies are emerging, such as Spark Therapeutics’ Luxturna, which marks the first FDA approval in a new class of one-time gene therapy treatments targeting inherited diseases. In this environment, companies will need to shift their focus to how they can play strategically and optimize the value of their orphan therapies.

Caption: Orphan drug approvals are expected to reach a similar level as 2018, with new tissue agnostic cancer therapies poised for approval and increasing market opportunities for emerging gene therapies, especially those enabled by advances in CRIPSR gene-editing. Source: FDA Orphan Drugs Data

Caption: Orphan drug sales are expected to grow at an ~11 % CAGR over the next five (5) years and continue to gain share of the overall drug market as sales growth outpaces non-orphan drugs, despite expected introduction of newer generics and biosimilars for non-rare conditions. Source: EvaluatePharma

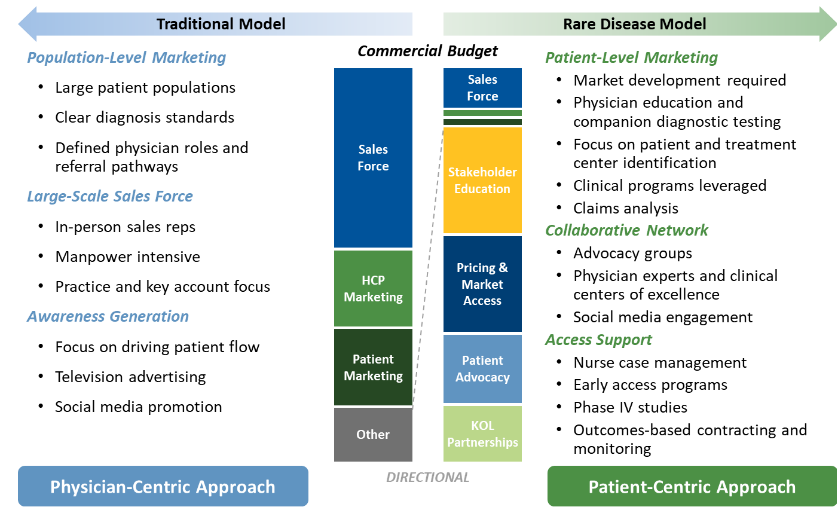

Launching an orphan drug is very different from launching a standard, non-rare disease drug. For companies to successfully commercialize rare disease drugs, they need to understand the critical differences between traditional and non-traditional (orphan) commercial models and rely on a new playbook to capture and maintain market share.

Caption: Rare disease companies face different challenges in effectively deploying their commercial budget, namely in developing the market by identifying patients, targeting leading treatment centers of excellence, and establishing KOL partnerships.

What makes commercializing rare disease drugs different? Rare disease drug companies need to consider launch from a patient-focused mindset rather than a traditionally physician-focused one. While traditional drugs depend on physician adoption and assume widely educated and diagnosed patient populations, the opposite is true for orphan drugs. Rare disease companies will have to manage their commercial budgets very differently, focusing on patient needs and setting the stage for:

- Targeted sales force development: In the rare disease drug space, quantity does not mean quality. Sales teams need to address patient populations specifically, ensuring they are reaching the right customers with the right messaging. Small, agile, and cross-functional commercial teams will contrast with the larger, specialized sales teams used for traditional big-name therapies.

- Stakeholder education: Identifying the right physicians, patients, and care settings is a challenge unique to the orphan drug market. Companies should expect to develop a market where limited educational resources, physician training, and diagnostics tools regularly inhibit accurate diagnoses of patients with rare conditions. Rare disease companies must be ready to develop their markets through targeted educational efforts and be armed with a thorough understanding of the addressable space. Many rare disease companies have established one-on-one nurse case management services to provide “personalized product support” to patients with treatment information, coverage options and authorizations, financial assistance, and care navigation. Examples of these services include Alexion’s OneSource Treatment Support and Shire’s OnePath program.

- Patient advocacy: Physicians and patient advocacy groups (PAGs) are often an essential part of care management for many patients. By sharing educational resources, helping to address financial issues, and creating awareness for patients to enroll in clinical trials, PAGs present themselves as a necessary resource not only to patients but to orphan drug companies as well. Drug companies should strategically align themselves with these types of groups to locate and engage patients throughout the drug approval process.

- Effective KOL partnerships: In orphan diseases, it is common for a small group of specialized physician researchers and Key Opinion Leaders (KOLs) to manage and determine treatment for a significant portion of an orphan disease population through reference centers of excellence. Companies should consider involving KOLs with late stage clinical studies to engage patients early and potentially jumpstart early access initiatives, such as compassionate use. KOLs are also valuable assets during drug development; a collaborative approach, for example via advisory boards, fosters trust and confidence in the product all the way through launch.

- Pricing and market access: For US companies, outcomes-based pricing and value-based contracting will become a primary focus for rare disease companies moving forward. Last year, Alnylam announced a value-based selling strategy for Patisiran, an increasingly popular approach to make the high cost of these drugs more palatable. In contrast, companies launching in Europe will face challenges as the market prepares for continued high cost drug launches and a higher bar is set for outcomes in rare diseases with one or more marketed therapies.

Rare disease drug companies must be ready to actively engage in market development and support targeted efforts within this fragmented arena. In the next part of this series, we will understand why stakeholder education plays a critical role in market development for rare disease drug companies and how they can successfully capitalize on the opportunity despite the unique challenges it presents.