Patient Advocacy Groups (PAGs)

1 in 2 rare diseases do not have a dedicated foundation or research support group. In the US, that number translates to close to 15 million patients navigating a complex journey without a dedicated team supporting them and ultimately seeking out a life-changing treatment. As the rare disease market continues to grow and evolve, so will the focus on patient engagement and advocacy, led in part by patient advocate leaders and community patient advocacy groups (PAGs).

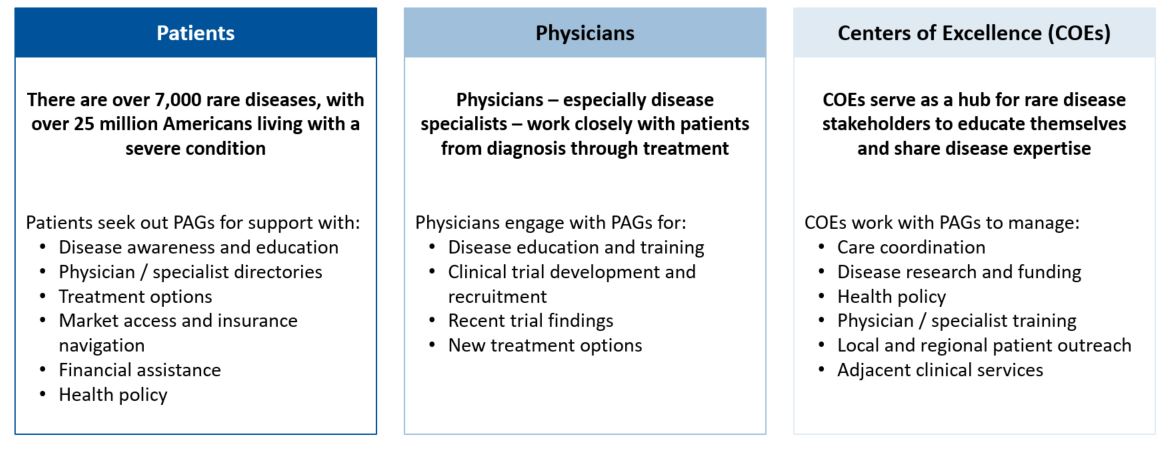

PAGs engage with three primary rare disease stakeholders

Caption: Patient Advocacy Groups work with stakeholders across the rare disease patient journey and can be a valuable partner to biotech companies.

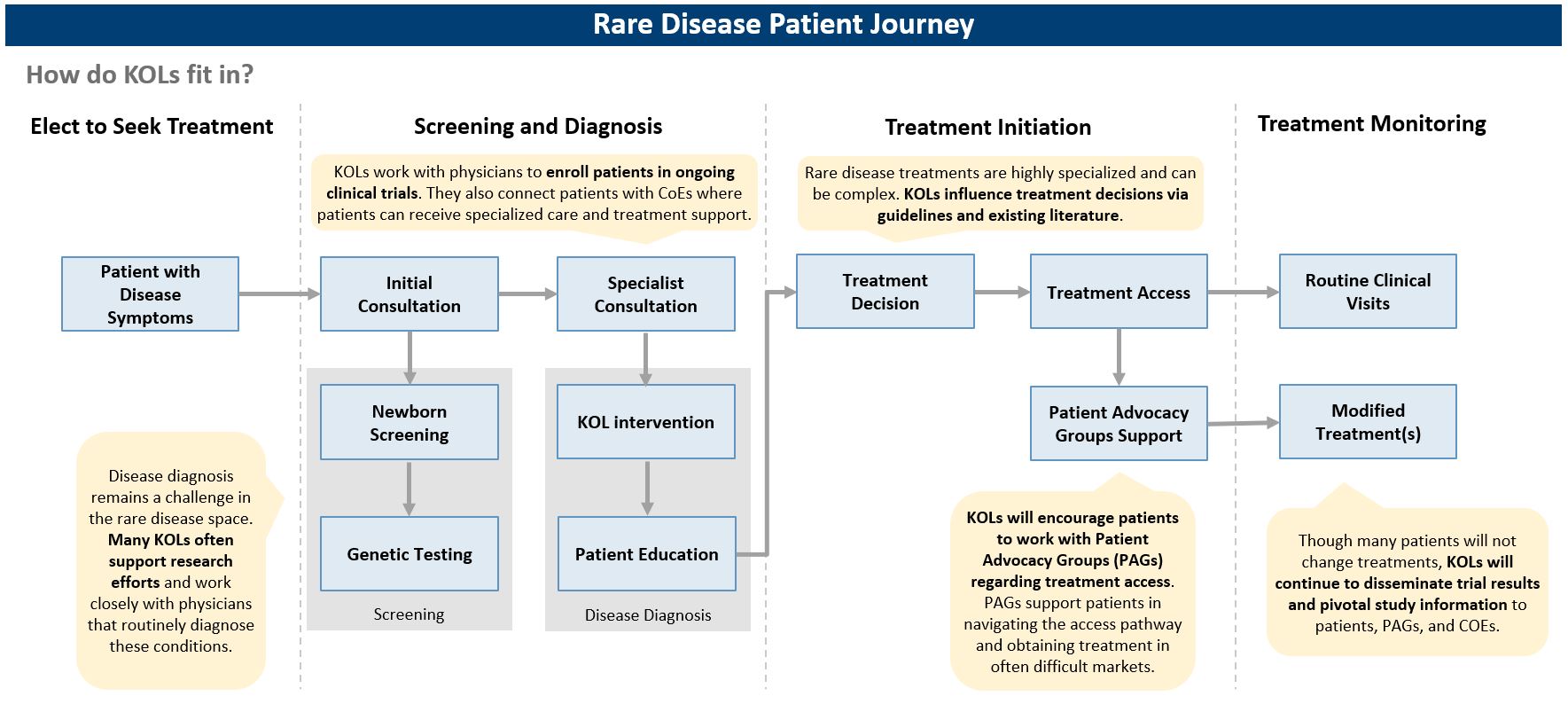

Patient advocacy groups (PAGs) are at the crux of a highly complex healthcare landscape. They play a central role in connecting several stakeholders and work as liaisons between patients, physicians, biotech companies, and community leaders. Companies frequently team up with PAGs to engage patient populations and offer support – such as treatment access and care – to both patients and caregivers. Patient Advocacy Groups also work with community leaders and far-reaching KOL networks to raise disease awareness and influence legislation and / or local policy. Other valuable activities, such as patient identification, clinical trial recruitment, and R&D collaboration, also support the indispensable role of PAGs in the rare disease market.

PAGs come in different shapes and sizes

Caption: Rare disease patient advocacy groups come in all shapes and sizes, supporting patients of many rare diseases at various levels – national or global.

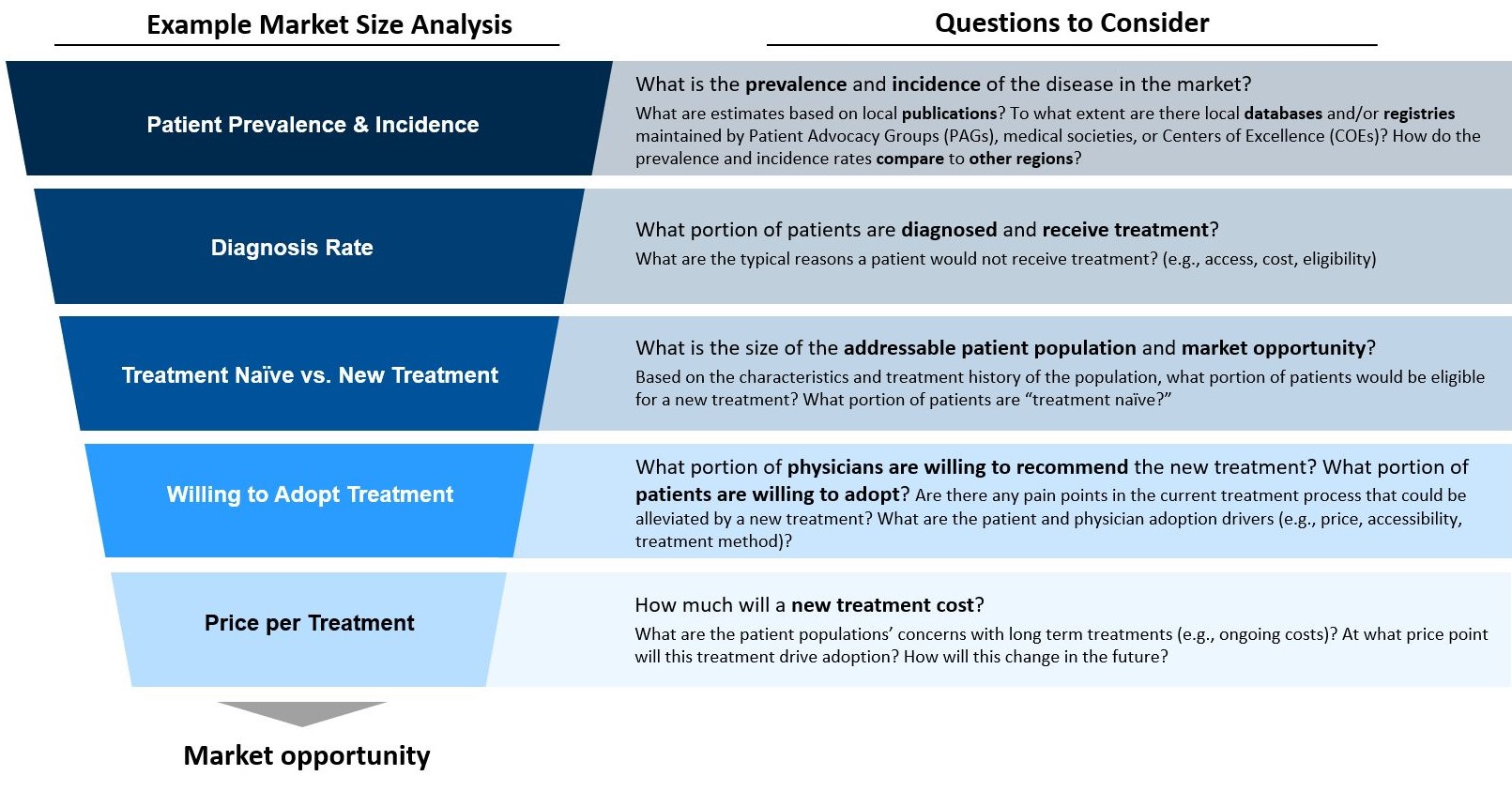

The patient-focused nature of the rare disease space makes working with patient advocacy groups a necessity, not an option. While many companies may know the value that comes from PAG collaboration, they may not know how to go about having these conversations and develop a successful strategy. Companies should first thoroughly understand the various roles PAGs play in crafting an effective strategy and engage with these communities. Companies can take the knowledge they gain from these conversations to raise awareness, improve quality of life, and positively transform the treatment landscape for rare diseases. PAGs can support rare disease companies…

- …as Patient Advocates

It’s in the name: Patient Advocacy Groups, or PAGs, are there first and foremost to be advocates for patients. PAGs are very close to the patient journey and have a unique perspective on it, including unmet needs and ongoing challenges. These organizations support patients and caregivers in seeking out treatment centers, navigating complicated access pathways, and obtaining financial assistance. PAGs are direct advocates, often lobbying in the public domain and influencing regulators to improve patient access. Biotech companies should invest in long term collaborations with PAGs to create an open dialogue about how to successfully engage with patients, such as marketing tactics or educational tools. These conversations may unearth existing challenges or unmet needs for patients that companies can capitalize on and use to differentiate themselves. Insight into patient unmet needs also provides perspective on what types of services and support patients require, and new product or support offerings can be directly informed by these conversations and custom-designed to meet patient needs. Feedback on existing support services and disease challenges can help companies also refine their customer-facing strategies.

- …as Educational Partners

With many rare diseases lacking educational resources, PAGs are crucial to minimize gaps in disease awareness. Besides providing patient and care education, they also work closely with COEs and KOLs to disseminate information about ongoing trials and new treatments, while encouraging patients to explore their options. The ongoing campaigns and awareness efforts often culminate in policy appeals and can even shift the treatment paradigm in the long term. Companies should consider this an opportunity to educate not only patients, but physicians as well, who are navigating a complicated diagnosis landscape with many unknowns. Diagnosis remains a large gap and could bring a big payoff to companies if they are able to develop new tools or tests to increase the diagnosis rate. Companies should strategically align themselves with PAGs to demonstrate a commitment to educating and supporting the patient population – a commitment that will reap impressive benefits later down the road.

- …as Research Partners

PAG proximity to the patient journey makes them a valuable resource in not only selecting treatments, but in developing them. Like KOLs, PAGs support clinical trials by identifying patient populations and referring patients for recruitment. Furthermore, as the voice of the patient, PAGs are pivotal in pushing novel or first-in-class therapies through the pipeline. Their firsthand experiences with patients can inform clinical trial design, from determining best-fit patient profiles to establishing trial endpoints. As mentioned earlier in this series, an early-stage collaboration can set companies up for success as they think through treatment protocols and, eventually, product commercialization. Questions around clinical trial endpoints, treatment administration, and existing treatment protocols can be very valuable when preparing for drug development and design. Working directly with patients and physicians gives companies a first-hand understanding of their customer profile and can better inform the product and its strategy.

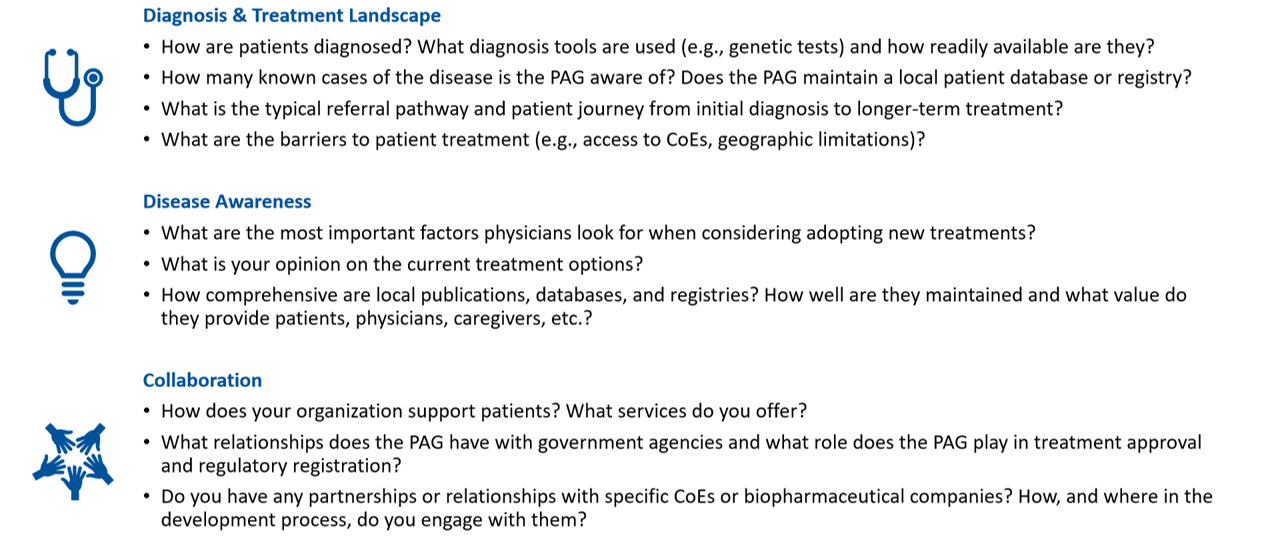

What questions should rare disease players be asking PAGs?

Caption: How should companies guide conversations with PAGS? Companies can look for gaps in the current landscape and identify opportunities to add value to stakeholders across the care continuum.

Patient advocacy groups will always be front and center in the rare disease space, focusing on their patients and advocating for new and effective treatments. Engaging in conversations around the treatment landscape, disease challenges, and unmet needs can present companies with an opportunity to establish a trusted presence in the market. Companies should be excited to partner with these groups and do so early; loyalty within the rare disease landscape benefits all stakeholders – not just the patients.