For Patient Engagement solutions looking for an exit, 2023 could be their year

For Patient Engagement solutions looking for an exit, 2023 could be their year

After a fraught 2022 that saw a significant slowdown in acquisitions from 2021’s volume and valuation highs, product companies view M&A as a potential strategy in 2023 to enhance their value proposition and achieve efficiencies of scale. Deal volume may rebound moderately from a slump in the latter half of 2022 while lower valuations are likely to result in reduced average deal size. Kx took the opportunity to validate industry signals at events in Q4 2022, gauging deal sentiment through conversations and a survey.

Amidst the record-setting number of attendees from across the healthcare ecosystem at HLTH Conference 2022, health tech leaders were abuzz with 2023 growth plans, key concerns, and areas for excitement. Kx’s Digital Health team met with dozens of solution company C-levels, corporate development, and strategy leaders who expressed one common sentiment with surprising frequency: “we are ready to do a deal, or two.”

To further gauge the Mergers & Acquisitions sentiment expressed by leaders on the show floor, in the networking lounges, and even at the puppy park, Kx surveyed over 350 HLTH attendees. The results confirmed Kx’s ingoing hypothesis: technology providers are cautiously optimistic on M&A for 2023 due to both sell- and buy-side dynamics. On the buy side, some vendors prefer inorganic growth while others view acquisition as a quicker route to enhanced offerings and improved efficiencies. On the sell side, cash constraints and the possibility of a down-round may motivate start-ups to consider an M&A exit.

Digital health leaders interpret M&A in 2023 as a potentially attractive option to augment their offerings and address the market forces that are top-of-mind concerns to their customers, including staffing shortages & provider budget shortfalls, inflation & the looming economic downturn, and increased emphasis on patient experience and engagement. Customer requirements continue to grow, demanding tangible proof of efficacy, demonstrable ROI soon after implementation, and options for meeting patient/member expectations for convenient consumer experiences. The market continues to prefer multifunctional platform options – ideally those that perform as well as individual point solutions. Vendors see the need to position themselves as an “enterprise, end-to-end” solution that reduces the burden on their customer to stitch together disparate systems & data sources and engage with their patients/members.

Vendors with aggressive product roadmaps may find that they prefer a buy-and-build approach vs. de novo build to bulk out their offerings. This is especially true for revenue-generating acquisitions with at least some penetration in the market and further expansion potential.

More specific Kx Survey findings include:

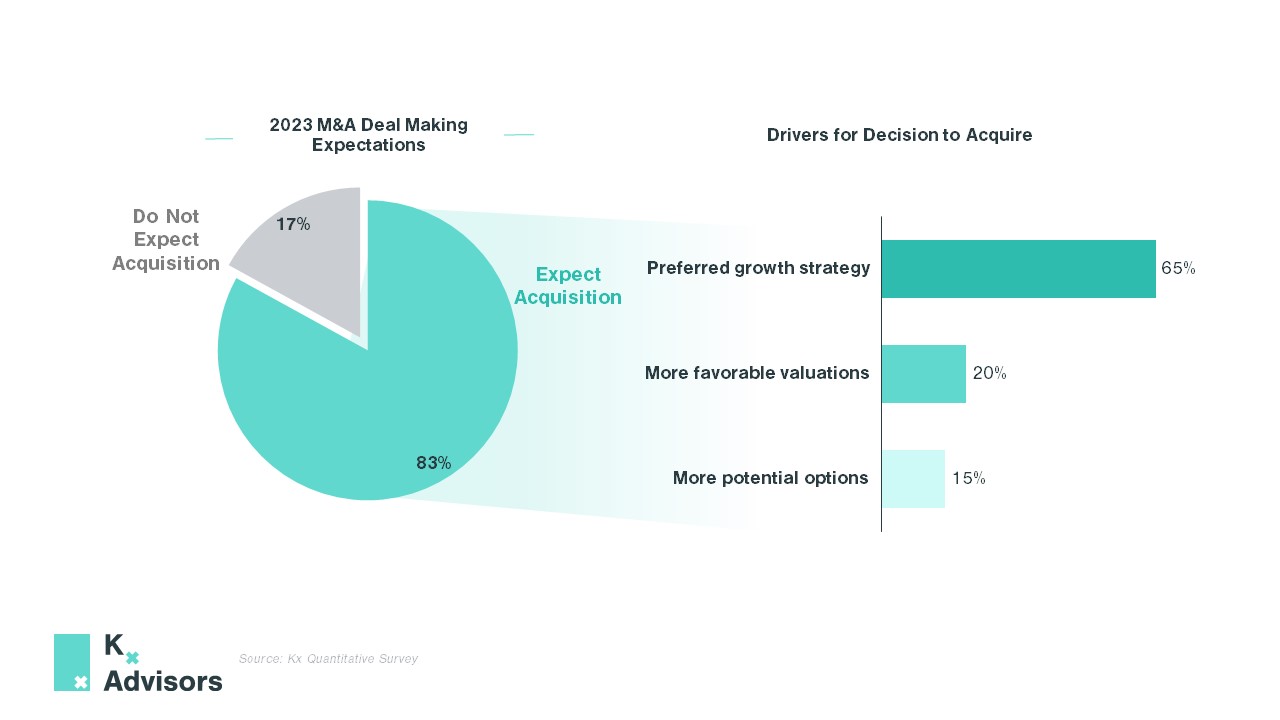

- Over 83% of respondents anticipate their organization will complete at least one acquisition this year.

- Of survey respondents whose organizations closed at least one deal in 2022, two-thirds anticipate no change in the size of deals while the remainder foresee a slight decrease in size

- Regardless of their company’s size, respondents indicated three main acquisition drivers:

- Nearly two-thirds indicated growth via acquisition is their organization’s preferred growth strategy;

- 20% indicated that more favorable valuations enhance the attractiveness of pursuing an acquisition;

- The increase in companies open to acquisition was the key motivator for the remaining 15% of respondents

- Respondents view acquisitions in 2023 as a tactical opportunity to execute within their core markets or expand into a closely adjacent market rather than expanding into new markets

- While many more organizations expressed intent to complete deals in 2023 vs. 2022, respondents expect the same amount of or a slight decrease in competition

- One area where significant competition may arise is Patient Engagement/Digital Front Door solutions

- 80% of respondents that intend to complete an acquisition in 2023 indicate Patient Engagement and/or Digital Front Door companies as their top priority

- Solutions in Screening, Monitoring, and Diagnostics ranked first for the remaining respondents

The heightened appeal of patient engagement/digital front door capabilities can be attributed to the coalescence of several macro-environmental factors, including:

- Labor shortages necessitating a shift to self-service workflows such as online scheduling;

- Consumer demand for personalized digital interactions prompting the implementation of algorithm and “AI”- driven chatbots and automated messaging

- CMS patient/member experience requirements encouraging streamlined intake, claims, and complaints processing tools like “digital front doors”

- Reimbursement & cost savings opportunities from Remote Patient Monitoring & Hospital at Home programs impelling user-friendly mobile apps integrated with EHRs

When compared to H2 2022 deal volume, it appears the 2023 digital health market is poised for some M&A uplift. Companies intend to face the current headwinds by focusing on their core markets and driving tangible value via enhanced capabilities for end users. Time will tell whether anticipated M&A activity materializes in 2023 as digital solutions continue to evolve and their impacts drive positive clinical, financial, operational, and experiential outcomes. Either way, Kx is already looking forward to the discussions about it at the 2023 HLTH Conference puppy park.

How Kx Can Help

Is your organization considering M&A to enhance your value proposition to customers? Is the decision made and you’re ready to move forward with landscape mapping, target identification, and due diligence? Kx’s Digital Health team supports clients throughout the process with tailored solutions informed by dialogue and reinforced by data.

Want to learn more? Contact Rachael England via e-mail (rachael.england@kxadvisors.com) or LinkedIn.