Health Equity:

The Kx Research Approach and Case Study

Health Equity in Advanced Treatments

How does health equity impact advanced treatments?

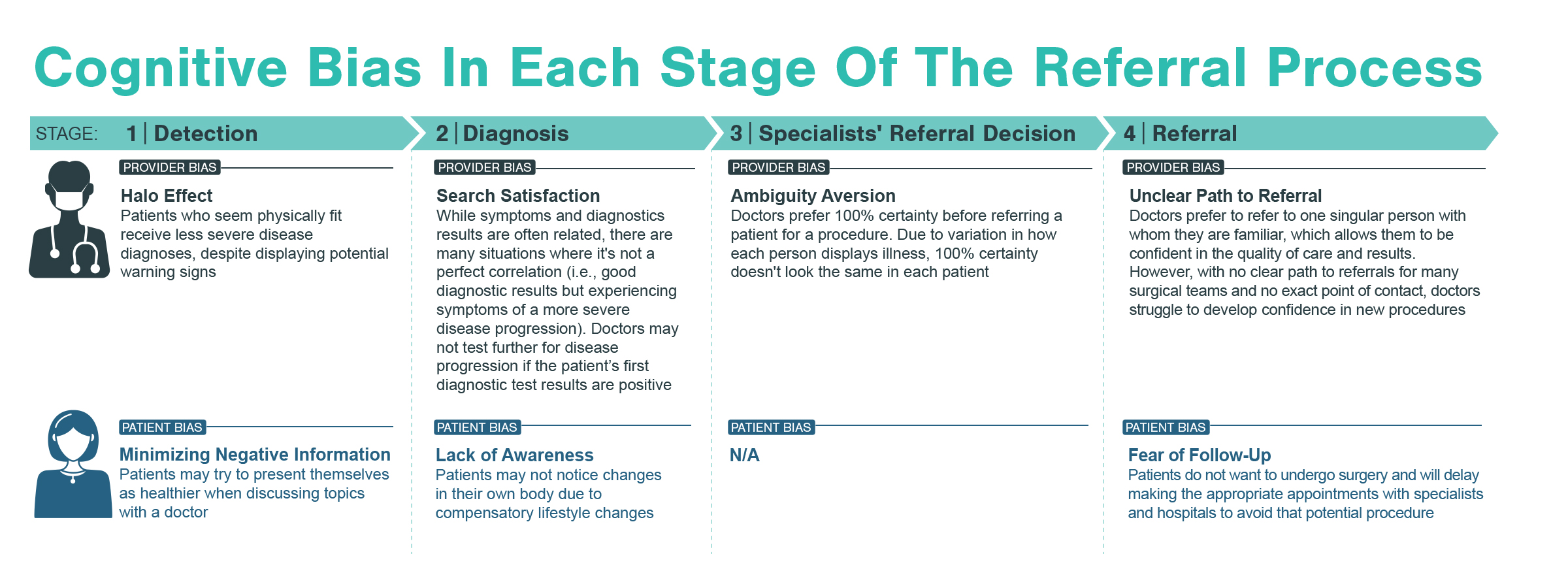

Advanced healthcare treatments require patients to pass through multiple specialists or undergo significant surgical procedures. As a result, health inequities are especially salient for patients to receive adequate and timely care. Specifically, in multi-step referral processes, patients move from one specialist to another, and receive a plethora of tests at each step. With the added inequities tied to determinants of health, like access, race, socio-economic status, education, and environment, the patient journey for advanced treatments can go from complicated to unnavigable.

Research on understanding the patient journey is the first step in identifying solutions for such inequities and is a necessary element of any health equity initiative.

How do you begin health equity research and initiatives?

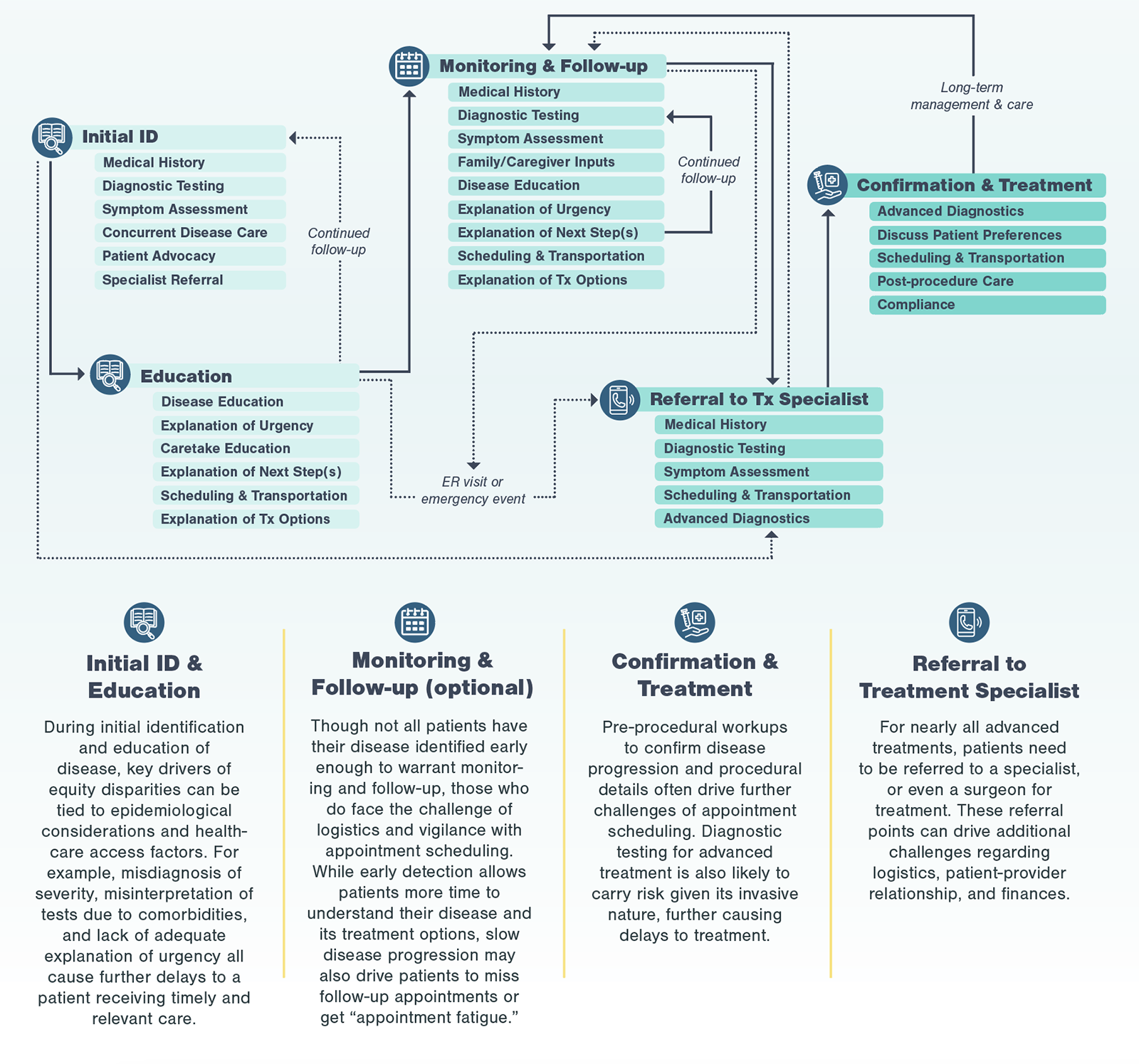

For companies looking to kick off health equity initiatives, start with defining a patient pathway. Doing so will help identify where general points of friction occur and set a “baseline” from which underserved peoples’ experiences may vary.

A typical patient journey goes from initial detection of disease to referrals to specialists to discussions of treatment options to the ultimate treatment a patient receives. At each point of the patient journey, patients may experience multiple inequities, layering on top of each other creating significant friction. For most diseases requiring advanced treatment (e.g., surgery, infusion treatments), patients go through four key stages, from initial identification and education to confirmation and treatment.

Even in the most efficient and straightforward cases, going through the standard care pathway to reach a specialist may take months and involve at least three different diagnostic assessments.

In the following case study, Kx explores how to conduct health equity research in advanced treatments, like surgery or biologic usage, specifically focusing on challenges faced by Black patients.

Kx Case Study: Health Equity Research Identifying Barriers to Care for Black Patients Receiving Advanced Treatments

Define the Patient Journey

In disease management, a condition may first be detected by a general practitioner (GP), who then refers the patient to a specialist. Depending on the diagnostic testing and treatment types, patients may then go through multiple other specialists before receiving an advanced treatment. These patient journeys are often complex, and serve as a baseline for understanding patient challenges in obtaining treatment.

To start, Kx defined the process that all patients typically go through, regardless of race, when receiving advanced treatments, starting with initial ID and education.

Pinpoint Provider-Identified Challenges

After exploring the patient journey in advanced treatments, Kx identified four categories of stakeholders who interact with patients:

For the highest and most immediate impact, Kx focused research on specialists (core specialists, treatment administrators, and physician extenders & staff). To tease out unconscious biases, the Kx team designed interview questions to ask not only about a practitioner’s self-identified habits, but also trends they noticed among their peers. Furthermore, with the inclusion of relevant physician extenders, Kx was able to understand challenges from multiple perspectives.

Kx found physicians are highly aware of logistical challenges related to race. Physicians noted in their practice, Black patients have been disproportionately impacted by these barriers. For example, physicians noted the work-up and test requirements prior to surgery, such as dental examinations, can cause unnecessary delay for patients needing treatment. Also, lifestyle factors like poor diet and lack of exercise may lead to comorbidities, like diabetes, that further complicate results.

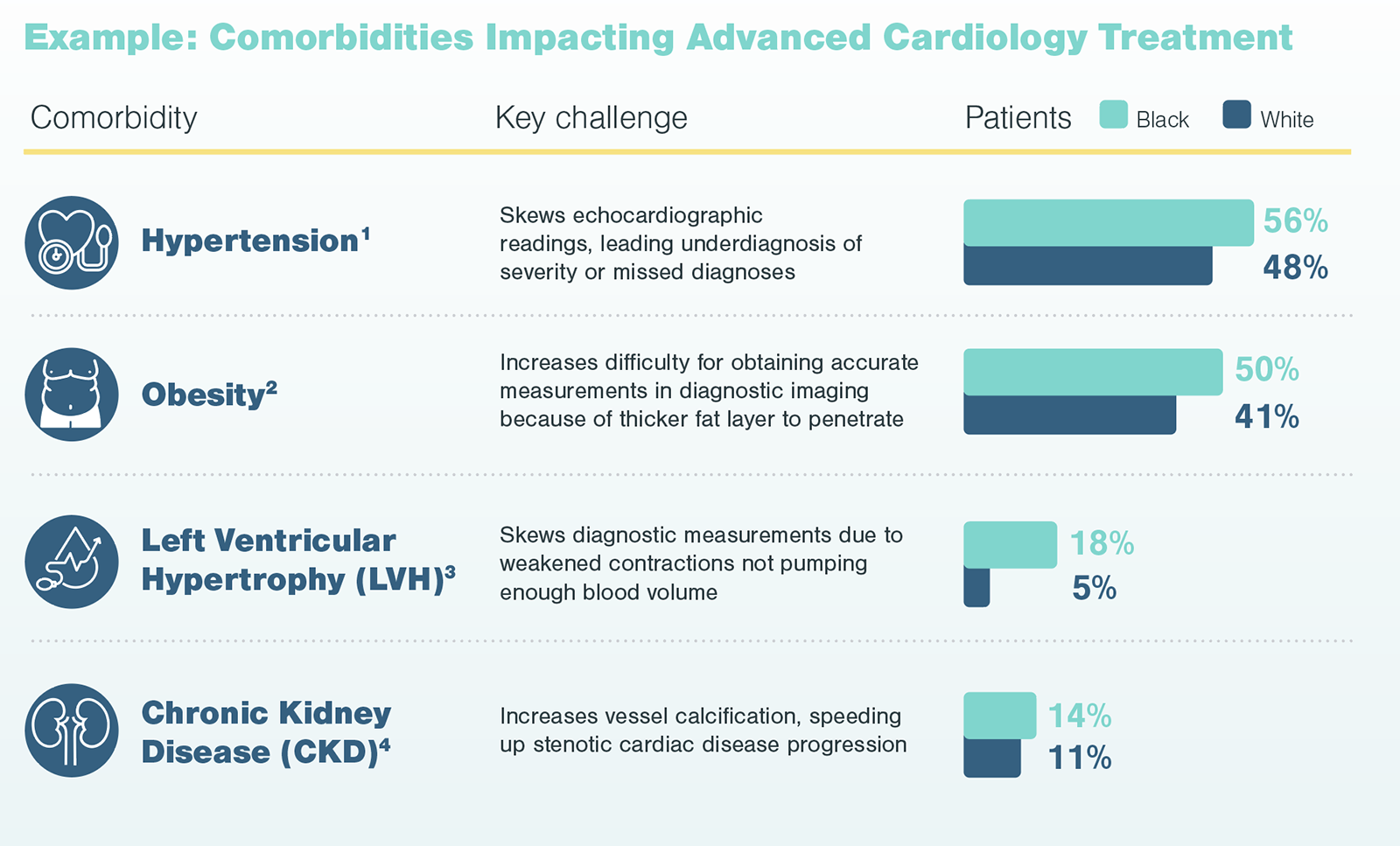

Additionally, diagnostic testing is often needed for the diagnosis and long-term follow up of patients on the pathway to advanced treatment. However, comorbidities (e.g., diabetes and hypertension), which are more prevalent among Black patients, can skew diagnostic measuring and symptom identification. In the case of advanced cardiological treatments, such comorbidities have specific and direct impacts on diagnostic echocardiograms, which are used to identify disease and assess severity.

Physicians struggled to self-identify challenges in recognizing patients’ disease understanding and prioritization of their healthcare. Specialists and relevant extenders acknowledge the process-oriented limitations of short patient interactions and long wait times but advocated for their own techniques and bedside manner. Many physicians also acknowledged generalized trends in their patient populations. Specifically, 1 out of 4 physicians interviewed mentioned observations related to Black patients and lower socioeconomic status that drive initial preconceived notions.

Understand the Patient Perspective

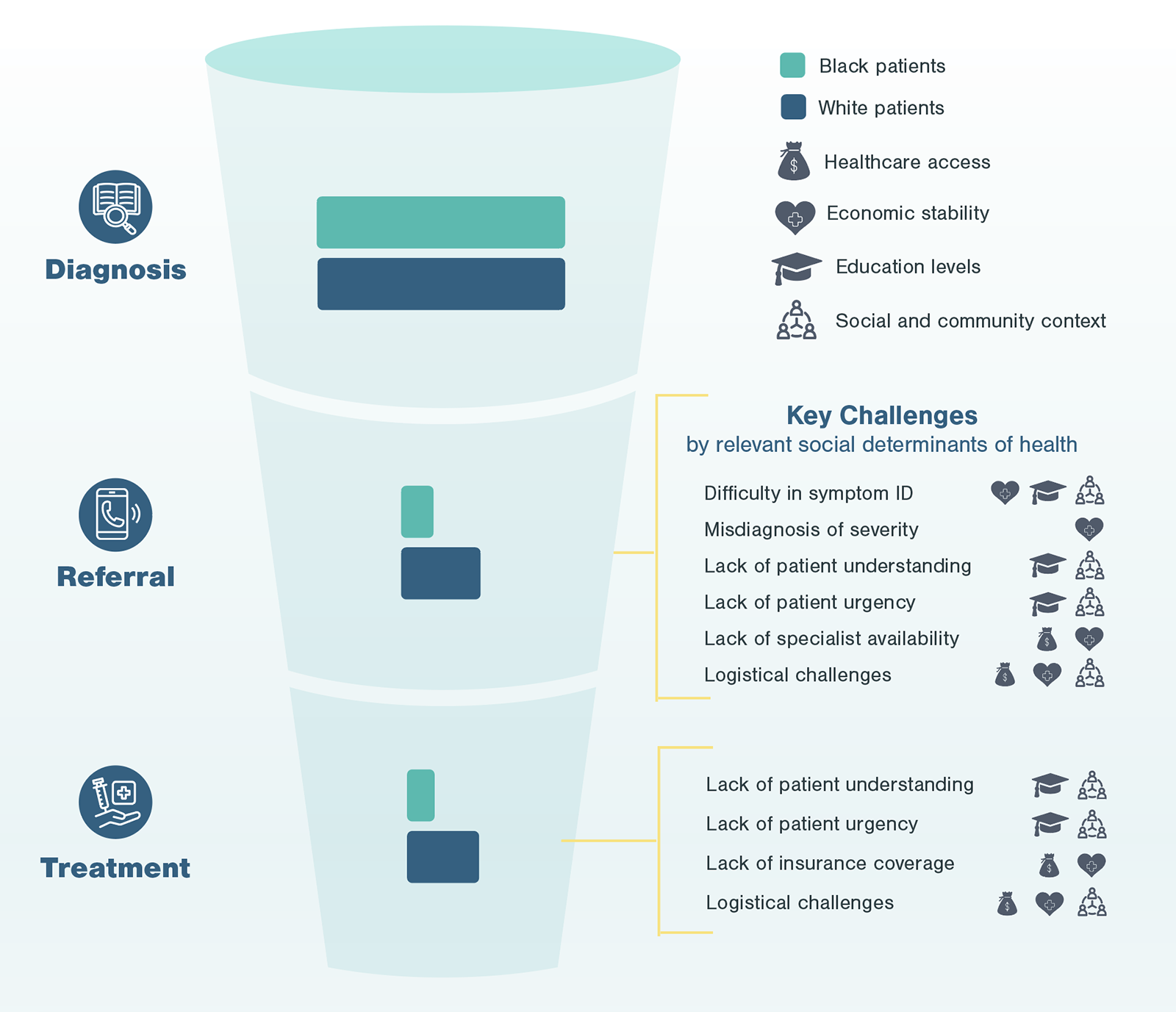

The next step of Kx’s research process focuses on gathering perspectives from patients. In the case of non-emergent cardiac surgeries, Black patients highlighted a number of challenges centering around social determinants of health which disproportionately impact Black patients in the US.

Through conversations with patients at different points of the advanced treatment pathway, it is evident these social determinants of health not only serve as predictors for individual challenges frequently faced by Black patients, but also impact the entirety of the experience. During patient interviews, Kx was able to identify, pinpoint, and aggregate the most frequent occurrence of challenges, whether during initial detection, follow-up, referral, or treatment.

Combining it with Epidemiological Evidence

Ultimately, after understanding patient and provider perspectives, Kx was able to combine findings with epidemiological evidence about patient flow-through by race and identify where patients were facing the most significant burdens.

Moving Forward

As more advanced treatments enter the US market, healthcare access and equity for Black patients become increasingly significant. The administrative requirements and time leading up to life-changing treatments can create obstacles and delay treatment for underserved or marginalized populations. However, healthcare providers and medical manufacturers that focus on the patient pathway to lower barriers to treatment can increase penetration of novel treatments and grow their eligible patient populations.

How Kx Can Help

With our expertise, Kx Advisors can guide your team in addressing health equities and targeting underpenetrated patient populations. Our experts will analyze the patient pathway to treatment, identify obstacles, and create a strategy to operationalize a health equity initiative. To learn more about how Kx can support your Health Equity initiatives, contact Evelyn Tee at evelyn.tee@kxadvisors.com.

References

- Ostchega Y, Fryar CD, Nwankwo T, Nguyen DT. Hypertension prevalence among adults aged 18 and over: United States, 2017–2018. NCHS Data Brief, no 364. Hyattsville, MD: National Center for Health Statistics. 2020.

- Stierman B, Afful J, Carroll MD, Chen TC, Davy O, Fink S, et al. National Health and Nutrition Examination Survey 2017–March 2020 prepandemic data files— Development of files and prevalence estimates for selected health outcomes. National Health Statistics Reports; no 158. Hyattsville, MD: National Center for Health Statistics. 2021. DOI: https://dx.doi.org/10.15620/cdc:106273..

- Garg S, de Lemos JA, Matulevicius SA, et al. Association of concentric left ventricular hypertrophy with subsequent change in left ventricular end-diastolic volume. Circulation: Heart Failure. 2017;10(8). doi:10.1161/circheartfailure.117.003959

- Centers for Disease Control and Prevention. Chronic Kidney Disease in the United States, 2021. Atlanta, GA: US Department of Health and Human Services, Centers for Disease Control and Prevention; 2021.

- Poverty rate by race/ethnicity. KFF. https://www.kff.org/other/state-indicator/poverty-rate-by-raceethnicity/currentTimeframe=0&sortModel=%7B%22colId%22%3A%22Location%22%2C%22sort%22%3A%22asc%22%7D. Published October 28, 2022. Accessed April 10, 2023.

- Lopez C, Kim B, Sacks K. Milken Institute; 2022. https://milkeninstitute.org/sites/default/files/2022-05/Health_Literacy_United_States_Final_Report.pdf. Accessed April 10, 2023.