5 Misconceptions for MedTech Market Access Strategy

Market access in MedTech is a complex and rapidly evolving environment, with increasingly intense scrutiny on the costs and benefits of new technologies as the pressure on budgets increases globally. The ability to prepare for and navigate market access strategy is, now more than ever, crucial to the success of a new product, and is frequently assessed by potential partners and acquirers with the same priority as the scientific rationale or potential for favourable regulatory approval.

During the recent MedFit 2022 event in Grenoble, we discussed the most common pitfalls that may affect market access planning and strategy with leading European experts and start-up companies. Here are the top five misconceptions for market access strategy we identified.

“We want to get the approval first, then we will plan for market access”

Engagement with payers early in product development is essential. Companies should define a path to reimbursement, and understand how payers will assess their product, as early as the concept stage to use payers’ feedback to shape the technology into a marketable product and create patient and company value. Leaving engagement with payers until late in development, or after approval, can often lead companies to:

- overlook crucial requirements

- mistarget patient populations

- fail to expectations to gain market access

- fail to gain critical pricing insights to size the commercial potential

Missing the opportunity to treat payers as your sounding board can cause delays and significant restrictions in access, while timely and iterative payer engagement has the potential to speed up the development process.

“The evidence we are generating for regulators will be sufficient for our market access strategy”

Regulatory decisions are at the top of priority lists for MedTech entrepreneurs both in the US and Europe. Selection of the right pathway and preparation of required submission dossiers are time-consuming and costly and constitute a necessary condition for market access. Late-stage start-ups agree, nonetheless, that it is far from sufficient, and payers themselves corroborate this perspective. In a recent Kx Advisors study, 100% of interviewed executives for major US payers agreed going beyond the evidence required for regulatory approval is key for market access strategy. Payers increasingly require demonstration of patient value not only with differentiated clinical efficacy and safety but through increased compliance and improved patient outcomes and satisfaction. They are also seeking additional sources of data, such as real-world evidence, insurance claims, and adverse event reports. MedTech companies should plan and pre-empt these requirements by carefully designing their studies for a payer-targeted set of endpoints as early as possible and generating evidence with not only regulators but also payers in mind.

“There is an established price for devices like ours”

Existing pricing and reimbursement benchmarks provide valuable insights for market access strategy, as showing cost-effectiveness in comparison to the current standard of care is an important part of any MedTech company’s economic narrative. However, payers’ focus is shifting towards a more holistic view, with greater interest in:

- improved patient outcomes

- demonstrated longer-term value

- ease of use

- adherence to treatment

- patient satisfaction

Four out of every five payers recently interviewed by Kx Advisors indicated a preference for increased value over purely lower cost of treatment and were ready to assess pricing based on a complete view of benefit for the patient and healthcare system. The approach MedTech companies take to frame, measure, and present this value becomes a tactical choice, and a key element of a broader commercialisation strategy, that should not be dismissed or made based on a simple competitive analysis.

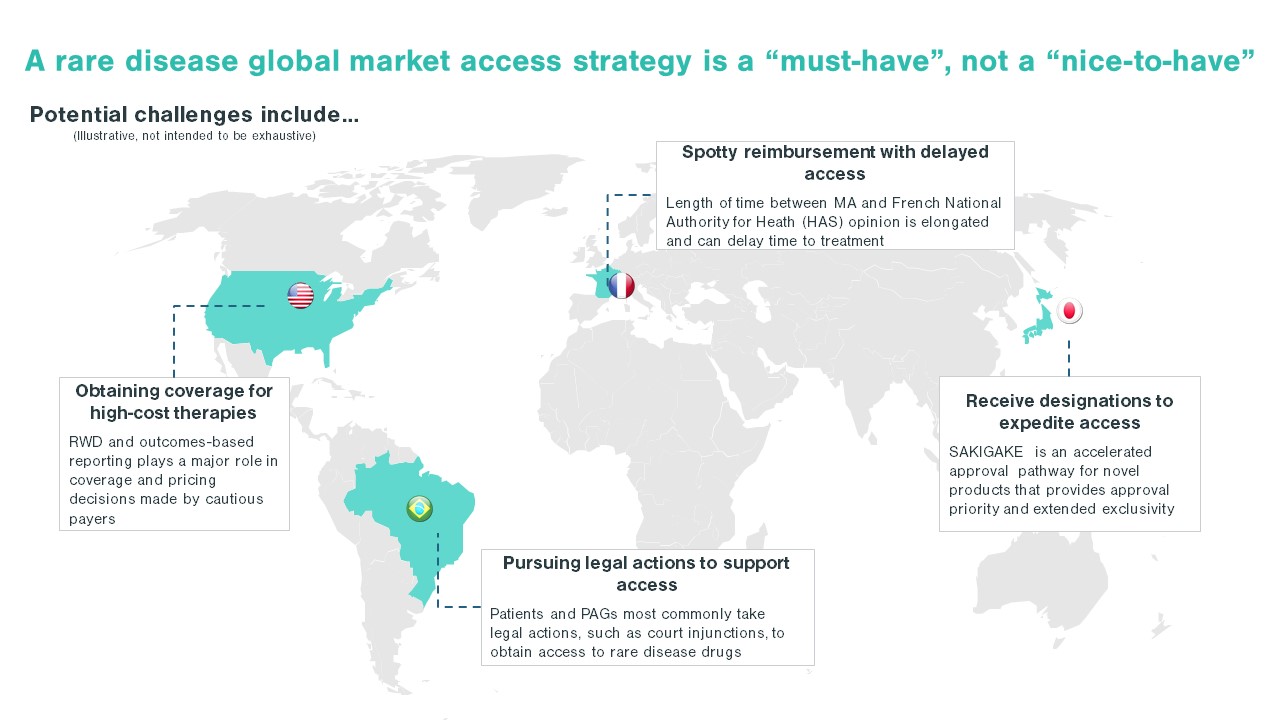

“We will focus on a market we know and aim for broad market access”

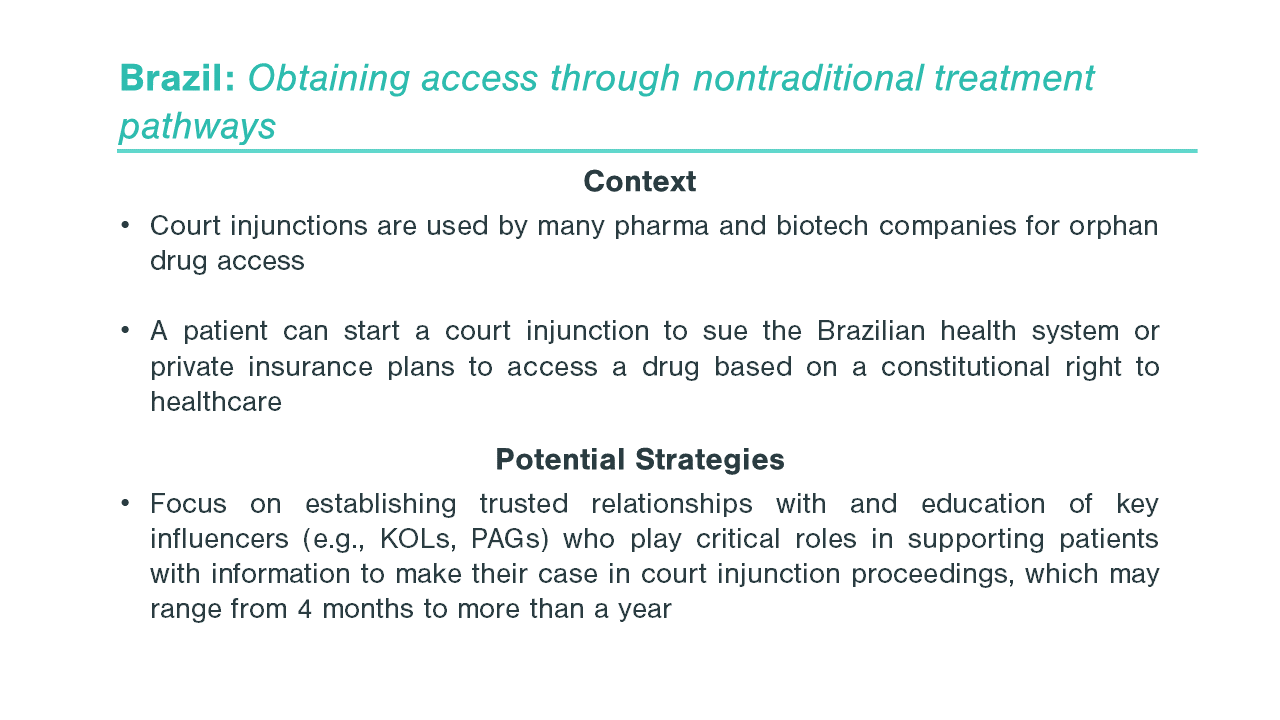

Many MedTech companies decide to first target their home geographic market, building on their familiarity with it, knowledge of the local language and system, and network of contacts. This approach, while easier from a product development perspective, may not allow companies to fully capture their commercial potential. In conversations with Kx Advisors, start-ups with prior product launch experience highlighted the need for fast market deployment and the value of testing the product with first adopters (and getting the product paid for early on) typically outweighs the breadth of market access. The choice of the first markets in which to launch is a strategic decision, and market access becomes one of the key drivers that should be considered in careful prioritisation of the highest potential markets. Entrepreneurs should be aware of both regional (e.g., US vs EU) and intrinsic (e.g., openness to innovative technologies) differences among payers, as well as differing patient population structures and accessibility, and explore avenues that expedite first market access, such as targeting research institutions or venturing into new geographies.

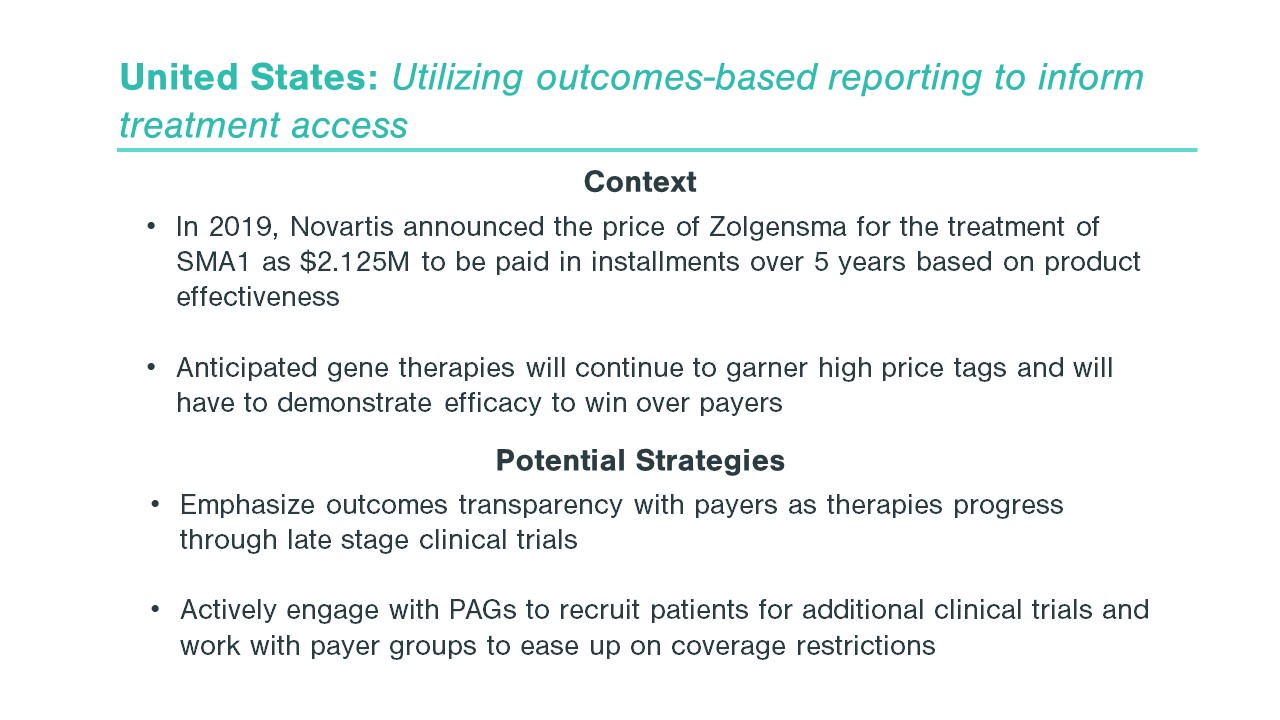

“Payers are not willing to consider innovative reimbursement models”

Getting paid for innovative technologies is notoriously difficult, especially when there is no easy way to make them fit within the established market access pathways for medical devices. The emergence of digital therapies and connected health, as well as the ongoing shift towards at-home therapies accelerated by the COVID pandemic, have only made the landscape more complex. At the same time, the awareness and urgency to address these challenges is on the rise among payers. Approximately 60% of payers recently interviewed by Kx Advisors stated they are exploring value-based reimbursement options and new, alternative pricing models for medical technologies (e.g., subscriptions or device-as-a-service arrangements) will be an increasingly welcome element of future coverage decisions. Building a differentiated market access strategy that accounts for multiple possible business models and reimbursement scenarios and exploring those early with key stakeholders can allow MedTech companies to create and leverage these opportunities.

Has your commercialisation strategy ever been impacted by any of these common misconceptions? Or are you currently facing other strategic decisions that will be crucial for your MedTech company’s growth? Feel free to contact Kx Advisors for a follow-up discussion.

Jenna Riffell is a Managing Partner at Kx Advisors, based in London.

Przemek Czerklewicz is a Principal at Kx Advisors, based in London. During the recent MedFit Event 2022 he led an expert panel titled “Innovators’ checklist for market access”.