Women’s Health: The Opportunity in Gynecology and Beyond

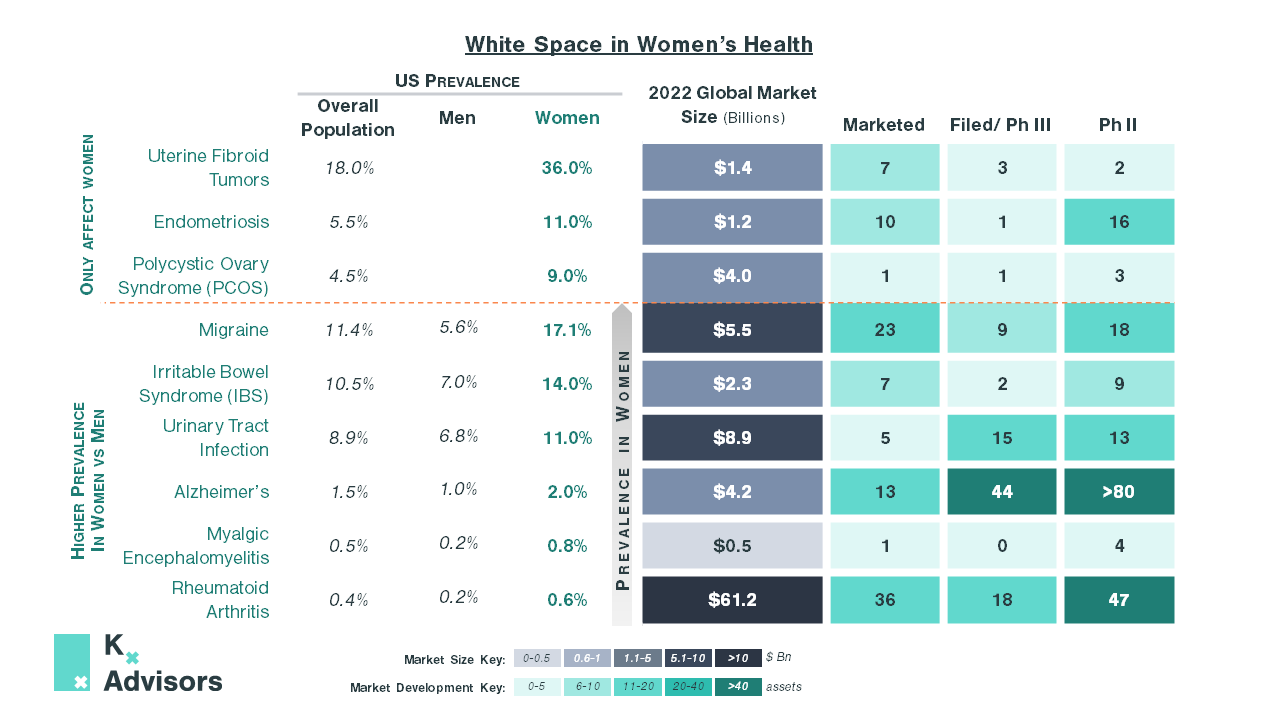

Women’s healthcare and FemTech are garnering increasing attention, yet unmet need remains high, leaving opportunity for investment in an area with significant white space for growth. In this article, we highlight why investment in women’s health is important, where funding gaps lie, and demonstrate the potential for growth if these markets receive sufficient research and development (R&D).

An Underfunded Area in Healthcare

Women comprise half of the population worldwide, yet the women’s health space, which Kx defines as diseases only or disproportionately affecting women, has been consistently underfunded and often disregarded.

In 2021, excluding oncology, only 2% of treatments in the development pipeline were for women’s health conditions. In the US, a recent study analyzing National Institutes of Health (NIH) funding found that 93% of diseases underfunded by the NIH disproportionately affect women, while 58% of overfunded diseases are male-dominant.1 Lack of scientific knowledge of women’s health conditions can then make companies reluctant to develop treatments, a risky venture even when knowledge of the disease is advanced.2,3

Case Study: Endometriosis

| Endometriosis occurs in 10% of women between the ages of 15-45,4 typified by tissue similar to the uterine lining growing outside of the uterus. The resulting pain significantly decreases patients’ quality of life, negatively impacting their performance at work, personal relationships, and mental health. Diagnosis is challenging, due to low awareness of the disease and the need for a laparoscopy to make a definitive diagnosis, leaving many patients without appropriate treatment. On average, a patient with endometriosis incurs $10,000 more direct healthcare costs annually than those without, from inpatient, outpatient, and surgical treatment alongside prescription costs. Over-the-counter (OTC) pain relief medications costs are added to these fees. Furthermore, endometriosis costs the US economy over $2,000 more than the average worker in annual absence and short-term disability costs.5 Current treatment options remain limited to painkillers, laparoscopic removal of lesions, and hormonal therapies. For those contraindicated or unresponsive to these treatments, a hysterectomy remains the only option. Currently, the most effective pharmacotherapies are Gonadotropin Releasing Hormone (GnRH) analogs, such as elagolix (Orilissa) and relugolix (Myfembree, in combination with estradiol and norethindrone acetate), which work by inducing quasi-menopause. However, side effects including bone mineral density loss, depression, and severe nausea can be detrimental to a woman’s long-term health, and have led the FDA to restrict the duration an individual can stay on the treatment to just two years. The current pipeline looks similarly bleak. Kissie’s Linzagolix, the only treatment in Phase III, has the same GnHR mechanism of action but with greater levels of bone mineral loss compared to approved medications. Although Phase II therapies show more promise, the market remains wide open and given the high prevalence and unmet need in endometriosis, the successful development of a safe drug would likely garner high reward. |

It is not just gynecological women’s health conditions that have failed to garner sufficient R&D investment to develop effective treatments. For example, Irritable Bowel Syndrome (IBS) is a chronic disease with significant patient burden with a high prevalence in women (14%), who comprise two-thirds of all IBS patients.6 Symptoms, which include diarrhea, constipation, and bloating, can substantially impact everyday life. Inadequate treatments only targeting symptoms and low market development have left unmet need high.

There are multiple women’s health conditions ripe for development; collectively, the opportunity is vast. In endometriosis alone, a safe treatment displacing GnRHs could see peak sales of up to $3.9bn in the US.7-13

The Case for Investment

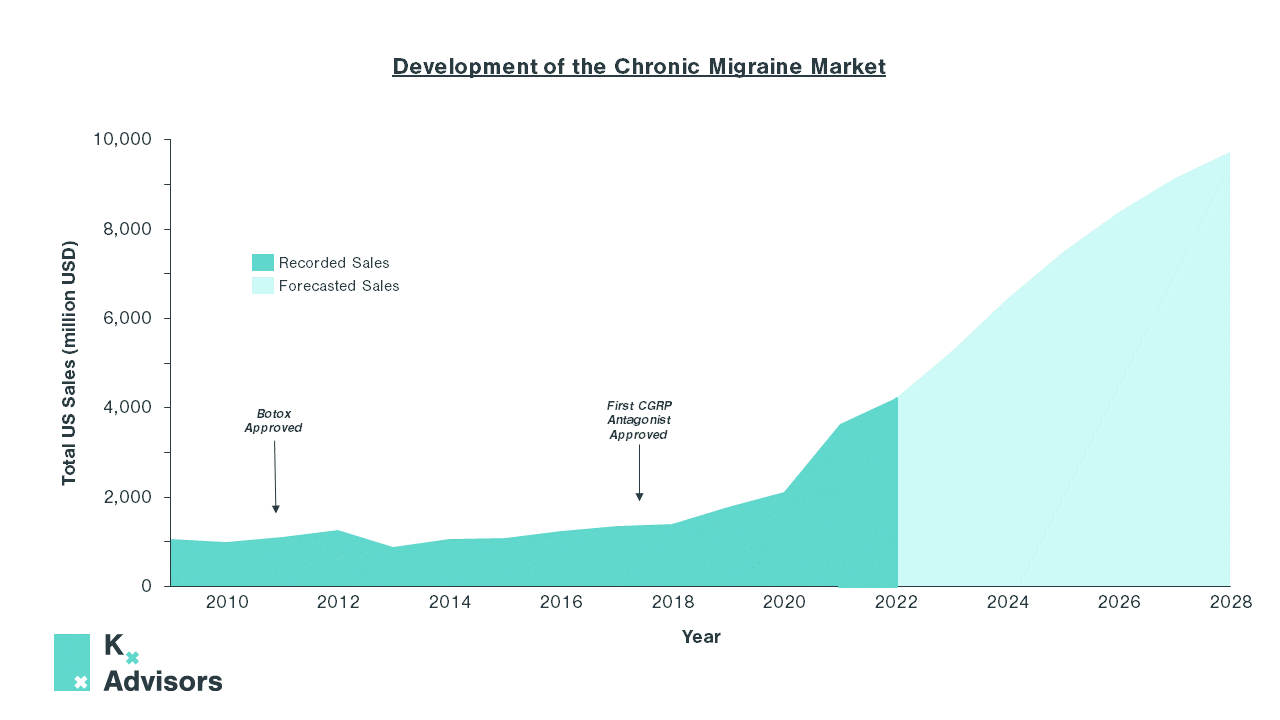

Some women’s health diseases that have already seen major market development offer an insight into the high potential patient value that can be unlocked with R&D and commercial investment.

Chronic migraine is one such example. Affecting 1 in 5 women vs 1 in 16 men, it is the leading cause of disability amongst young women.14 In 2009, the market was small, with US sales totaling $1.1bn.15 Treatment options were predominantly limited to triptans, an abortive class of medication that treats individual migraine episodes as and when they occur.16 Though effective, they are not preventative and are not suitable for those who suffer from more frequent episodes due to the risk of medication-overuse headaches (MOH), also known as analgesic rebound headaches.17

However, the market has since experienced explosive growth propelled by two treatment developments: the approval of AbbVie’s Botox in 2010 and, in 2018, the arrival of three calcitonin gene-related peptide (CGRP) antagonist mAbs; Aimovig (erenumab), Ajovy (freanezumab), and Emgality (galcanezumab). Both novel classes of treatment gave prescribers the tools to move away from treating the symptoms of chronic migraine, and towards preventing future episodes.

These landmark changes in the treatment paradigm resulted in a 200% increase in annual US sales in the last four years, from 2018 to 2022.15 Since 2020, newer oral CGRPs have been approved, further reducing patient burden in migraine. With these and further developments, the market is expected to continue to grow exponentially, with total annual US sales predicted to reach >$9bn by 2028.15

The high ROI within chronic migraine shows how a shift from reactively treating symptoms, as in endometriosis and IBS, to developing well-tolerated treatments targeting the underlying cause of women’s health diseases is both desperately needed and a significant upside opportunity. Multiple relatively untapped markets offer just such opportunity on this scale.

Polycystic ovary syndrome (PCOS), a largely understudied disease that causes metabolic issues, is one example. There are no approved treatment options despite its high prevalence, significant impact on quality of life due to hirsutism, sub-fertility, and increased risk of comorbidities such as type 2 diabetes. The generics used such as combined oral contraceptives and metformin, although effective at inducing ovulation, have little impact on metabolic issues and have tolerability concerns. The development pipeline is also particularly bleak and offers limited potential to address the high unmet need.

In irritable bowel syndrome (IBS), as discussed earlier, unmet need is high with over half of patients dissatisfied with their treatment due to side effects and inadequate efficacy,18 though there are seven marketed treatments. Pipeline development is sluggish with only two drugs currently in Phase III and nine in Phase II. This slow development can largely be attributed to poor knowledge of disease pathogenesis, linked to chronic underfunding.

Conclusion

It is evident there is extensive opportunity and necessity for development in multiple women’s health conditions. Not only are these diseases often chronic and highly prevalent, but they can significantly impact patients’ long-term health outcomes and quality of life, both key for pricing potential and market access.

Unlocking the opportunity in women’s health will require development beyond R&D. To truly address high unmet need and maximize the market opportunity, pharma companies and investors should adopt a three-pronged approach:

- Increasing awareness of women’s health diseases is vital. In endometriosis, for example, the average delay from symptom onset to diagnosis is 8 years, while 70% of patients with PCOS remain undiagnosed in primary care. Poor PCP awareness leads to misdiagnosis, slow referrals, and a prolonged impact on quality of life.

- Improving diagnostic tools is crucial to unlocking the full patient population. Endometriosis can only be confirmed with a laparoscopy, which is both invasive and expensive to healthcare systems, and for PCOS there is no single diagnostic test, making diagnosis challenging given the wide range of presenting symptoms. Developing diagnostic biomarkers in IBS could enable treatments to target the cause rather than symptoms, drastically improving patient outcomes.

- Targeting investment towards effective, safe therapies that go beyond treating symptoms is key to changing outcomes. Painkillers such as non-steroidal anti-inflammatory drugs (NSAIDs) or hormonal contraceptives are heavily relied upon, particularly in gynecological women’s conditions. However, not only are women trying to conceive unable to use hormonal contraceptives, but side effects such as headaches or nausea can be unpleasant or even life-threatening in the rare case of blood clots, leading to poor compliance rates.

How Kx can help harness the opportunity in Women’s Health

The experts at Kx Advisors help evaluate opportunities, develop strategy, prioritize pipelines, and bring new treatments in Women’s Health to market. Our unique approach combines real-world experience with qualitative and quantitative data to provide unique solutions supporting our clients’ strategic growth initiatives. To learn more about how Kx Advisors can support your goals in Women’s Health, contact Jenna Riffell at jenna.riffell@kxadvisors.com.

References

- Mirin AA. Gender disparity in the funding of diseases by the U.S. National Institutes of Health. Journal of Women’s Health. 2021;30(7):956-963. doi:10.1089/jwh.2020.8682

- Stengel G. Female Founders Are Energizing Investment in Women’s Healthcare: Expect More In 2023. Forbes. January 2023. https://www.forbes.com/sites/geristengel/2023/01/04/female-founders-are-energizing-investment-in-womens-healthcare-expect-more-in-2023. Accessed February 20, 2023.

- Norris J, Bousleiman R, Scolamieri A, Atsavapranee B. Healthcare Investments and exits report annual 2022. Healthcare Investments and Exits. https://www.svb.com/trends-insights/reports/healthcare-investments-and-exits?utm_source=svb&utm_medium=pr&utm_campaign=gb-2023-01-aw-tl-ag-na-lh-na&utm_content=1pr_pct_oc_na_di_na_lp_pr. Published January 2023. Accessed February 21, 2023.

- Endometriosis. World Health Organization. https://www.who.int/news-room/fact-sheets/detail/endometriosis#:~:text=Endometriosis%20is%20a%20disease%20where,and%20girls%20globally%20(2). Published March 31, 2021. Accessed February 21, 2023.

- Soliman AH, Surrey E, Bonafede M, Nelson JK, Castelli-Haley J. Real-World Evaluation of Direct and Indirect Economic Burden Among Endometriosis Patients in the United States. Advances in Therapy. http://doi.org/10.1007/s12325-018-0667-3. Published February 15, 2018. Accessed February 24, 2023

- International Foundation for Gastrointestinal Disorders. IBS Facts and Statistics. About IBS. https://aboutibs.org/what-is-ibs/facts-about-ibs/#:~:text=IBS%20affects%20between%2025%20and,3%20IBS%20sufferers%20are%20male. Published April 29, 2022. Accessed March 3, 2023.

- Worldometer. United States population (live). Worldometer. https://www.worldometers.info/world-population/us-population/. Published February 21, 2023. Accessed February 21, 2023.

- Wold Bank. Population, female (% of total population) – United States. https://data.worldbank.org/indicator/SP.POP.TOTL.FE.ZS?locations=US. Published January 1, 2021. Accessed February 21, 2023.

- World Bank. Population ages 15-64 (% of total population). https://data.worldbank.org/indicator/SP.POP.1564.TO.ZS. Published January 1, 2021. Accessed February 21, 2023.

- Shafrir AL, Farland LV, Shah DK, et al. Risk for and consequences of endometriosis: A critical epidemiologic review. Best Practice & Research Clinical Obstetrics & Gynaecology. 2018;51:1-15. doi:10.1016/j.bpobgyn.2018.06.001

- Bulletti C, Coccia ME, Battistoni S, Borini A. Endometriosis and infertility. Journal of Assisted Reproduction and Genetics. 2010;27(8):441-447. doi:10.1007/s10815-010-9436-1

- Bontempo AC, Mikesell L. Patient perceptions of misdiagnosis of endometriosis: Results from an online national survey. Diagnosis. 2020;7(2):97-106. doi:10.1515/dx-2019-0020

- Becker CM, Gattrell WT, Gude K, Singh SS. Reevaluating response and failure of medical treatment of endometriosis: A systematic review. Fertility and Sterility. 2017;108(1):125-136. doi:10.1016/j.fertnstert.2017.05.004 ages 15-64 (% of total population). https://data.worldbank.org/indicator/SP.POP.1564.TO.ZS. Published January 1, 2021. Accessed February 21, 2023

- Steiner TJ, Stovner LJ, Jensen R, Uluduz D, Katsarava Z. Migraine remains second among the world’s causes of disability, and first among young women: Findings from GBD2019. The Journal of Headache and Pain. 2020;21(1). doi:10.1186/s10194-020-01208-0

- Evaluate Pharma. Migraine: Indication Overview. Evaluate Pharma. https://app.evaluate.com/ux/WebReport/tabbedsummarypage.aspx?itemId=631&lType=modData&compId=1019&tabId=. Published February 15, 2023. Accessed February 21, 2023.

- Cameron C, Kelly S, Hsieh SC, et al. Triptans in the Acute Treatment of Migraine: A Systematic Review and Network Meta-Analysis. Headache. 2015;55 Suppl 4:221-235. doi:10.1111/head.12601

- De Felice M, Ossipov MH, Wang R, et al. Triptan-induced latent sensitization: a possible basis for medication overuse headache. Ann Neurol. 2010;67(3):325-337. doi:10.1002/ana.21897

- The Lancet Gastroenterology & Hepatology. Unmet needs of patients with irritable bowel syndrome. The Lancet Gastroenterology & Hepatology. 2018;3(9):587. doi:10.1016/s2468-1253(18)30236-x

- Alzheimer’s Therapeutics Market Size Report, 2022-2030. https://www.grandviewresearch.com/industry-analysis/alzheimers-therapeutics-market. Published July 2022. Accessed March 3, 2023.

- Acumen Research and Consulting. Irritable bowel syndrome treatment market size. https://www.globenewswire.com/en/news-release/2022/10/03/2526998/0/en/Irritable-Bowel-Syndrome-Treatment-Market-Size-is-expected-to-reach-at-USD-4-7-Billion-by-2030-registering-a-CAGR-of-9-5-Owing-to-Increasing-Incidences-of-Gastrointestinal-Disorder.html. Published October 3, 2022. Accessed March 3, 2023.

- DataM Intelligence. Uterine Fibroids Treatment Market. DataMIntelligence. https://www.datamintelligence.com/research-report/uterine-fibroids-treatment-market. Published June 6, 2022. Accessed March 3, 2023.

- Facts & Factors. Global demand of rheumatoid arthritis drugs market size & share to grow at a CAGR of 1.75%, expected to hit USD 70.1 billion mark by 2030 | rheumatoid arthritis drugs industry trends, Analysis & Forecast Report by FNF. Yahoo! Finance. https://finance.yahoo.com/news/global-demand-rheumatoid-arthritis-drugs-160000928.html#:~:text=In%20terms%20of%20revenue%2C%20the,growing%20cases%20of%20rheumatoid%20arthritis. Published February 2023. Accessed March 3, 2023.

- Global Data. Migraine drug market size, share & trends analysis and forecast by strategic competitor assessment, market characterization, unmet needs, clinical trial mapping and implications 2020 – 2030. Market Research Reports & Consulting | GlobalData UK Ltd. https://www.globaldata.com/store/report/migraine-market-analysis/. Published February 8, 2022. Accessed March 3, 2023.

- Grand View Research. Endometriosis treatment market size & trends report, 2030. Endometriosis Treatment Market Size & Trends Report, 2030. https://www.grandviewresearch.com/industry-analysis/endometriosis-treatment-market-report#:~:text=The%20global%20endometriosis%20treatment%20market%20size%20was%20estimated%20at%20USD,USD%201%2C328.89%20million%20in%202023. Published November 2022. Accessed March 3, 2023.

- Mordor Intelligence. Urinary tract infection therapeutics market analysis – industry report – trends, Size & Share. Urinary Tract Infection Therapeutics Market Analysis – Industry Report – Trends, Size & Share. https://www.mordorintelligence.com/industry-reports/urinary-tract-infection-therapeutics-market#:~:text=The%20urinary%20tract%20infection%20therapeutics%20market%20was%20valued%20at%20USD,the%20forecast%20period%202022%2D2027. Accessed March 3, 2023.

- Persistence Market Research. Polycystic ovary syndrome (PCOS) treatment market revenue to close value of US$ 6.31 bn with CAGR of 4.7% by 2032- persistence market research. GlobeNewswire News Room. https://www.globenewswire.com/en/news-release/2022/10/27/2542922/0/en/Polycystic-Ovary-Syndrome-PCOS-Treatment-Market-Revenue-to-close-Value-of-US-6-31-Bn-with-CAGR-of-4-7-by-2032-Persistence-Market-Research.html. Published October 27, 2022. Accessed March 3, 2023.

- Alzheimer’s Association. Why does alzheimer’s disease affect more women than men? new alzheimer’s association grant will help. Alzheimer’s Disease and Dementia. https://www.alz.org/blog/alz/february_2016/why_does_alzheimer_s_disease_affect_more_women_tha. Accessed March 3, 2023.

- American College of Rheumatology. Rheumatoid arthritis . https://www.rheumatology.org/I-Am-A/Patient-Caregiver/Diseases-Conditions/Rheumatoid-Arthritis. Published December 2021. Accessed March 3, 2023.

- Buck Louis GM, Hediger ML, Peterson CM, et al. Incidence of endometriosis by study population and Diagnostic Method: The endo study. Fertility and Sterility. 2011;96(2):360-365. doi:10.1016/j.fertnstert.2011.05.087

- Butler CC, Hawking MKD, Quigley A, McNulty CAM. Incidence, severity, help seeking, and management of uncomplicated urinary tract infection: A population-based survey. British Journal of General Practice. 2015;65(639). doi:10.3399/bjgp15x686965