Strategizing for Your First Drug Launch

Strategizing for Your First Drug Launch

Part 1 of Kx’s 3-part series

Introduction

“We have 12 months to either make it or break it post-launch”. This sentiment has echoed from one pharmaceutical board room to the next for years. And though it may be overused, for pre-revenue pharmaceutical companies planning to directly launch their first product, the idiom couldn’t be truer.

With increasing payer scrutiny, heightened competition in specialty drug markets, and more restrictive in-person access to HCPs due to COVID-19, achieving commercial success out of the gate is crucial for pharmaceuticals. In an analysis of 149 new drug launches, roughly 64% of drugs met or beat expectations in their launch years. Of those, 86% continued to meet or beat analyst expectations in year 2. For the drugs that missed expectations in year 1, 70% went on to miss again in year 2. Only about 30% managed to reverse course by year 3. (Deloitte, 2020). In other words, winning in Year 1 is paramount to a drug’s long-term success and ROI.

Unfortunately, drug research and development costs are on the rise (an estimated 8.5% YoY over general price inflation) (Joseph A DiMasi 1, 2016), and pre-revenue drug companies rarely have the resources and cash flow to mimic the commercial strategies of Big Pharma and legacy incumbents. Further, these “cookie-cutter” commercial strategies applied to the wrong market or product can kill a launch before it even begins. Still, there are unique competitive advantages held by commercial leaders at smaller pharmaceutical companies that cannot be matched by larger peers and incumbents:

- The full might of your commercial team is able to focus on one product

- Leaner organization size and operations enable nimbler post-launch commercial tactics

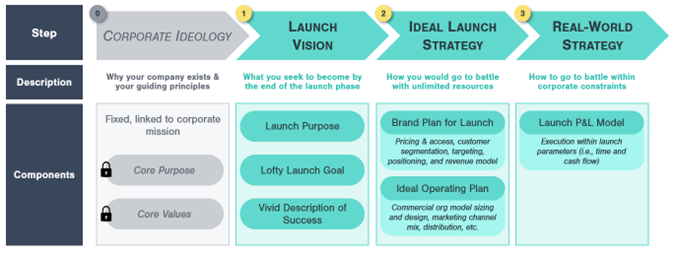

Kx’s blog series on Strategizing for your First Drug Launch is intended to support late-stage, pre-revenue pharmaceutical companies who are planning to directly commercialize their first product capitalize on these competitive advantages. Kx’s 3-step approach draws on concepts from academic experts such as James Collins and Jerry Porras and on our direct, real-world expertise consulting clients through launch planning. It is designed to help your company build a dynamic commercial strategy tailored to your drug:

- Cast a launch vision

- Build a brand plan and supporting operating plan around your drug

- Utilize a dynamic launch P&L model to refine your launch strategy to meet internal constraints

This first post in our 3-part blog series will focus on Step 1: the launch vision.

Cast a holistic launch vision with a guiding ‘north star’ and quantifiable goals before you start commercial planning

In a 1996 publication of the Harvard Business Review, James Collins and Jerry Porras asserted that “a well-conceived vision consists of two major components: core ideology and envisioned future. Core ideology, the yin in our scheme, defines what we stand for and why we exist. Yin is unchanging and complements yang, the envisioned future. The envisioned future is what we aspire to become, to achieve, to create – something that will require significant change and progress to attain” (James C. Collins, 1996). Kx agrees that the exercise of determining the core ideology of a company (i.e., its core values combined with its core purpose) should take place at a company’s inception, well before commercialization. However, because of the outsize impact a first drug launch can have on a pharmaceutical company’s holistic success, we recommend that executives revisit and repurpose three modified components of Collins’ and Porras’ framework to cast a “Launch Vision” specific to your leading asset:

1. Launch Purpose

The launch purpose should be distinct from the core purpose of a company. For instance, Pfizer’s corporate core purpose is to “deliver breakthroughs that change patients’ lives” (Pfizer, 2022). Yet, for their SARS-CoV2 vaccine launch in 2020, Pfizer consistently messaged a more focused launch purpose to “move with the same level of [timely] urgency to safely supply a high-quality vaccine around the world” (Pfizer, 2020). This launch purpose is both more specific, and also directly linked to the unique characteristics and launch environment of the drug itself. Because Pfizer launched a first-to-market vaccine, swift distribution and broad market access were necessary cornerstones of the launch to combat the pandemic.

To align on principles for the launch purpose, executives should consider a number of questions:

- What did we set out to achieve with this drug during R&D?

- What makes my drug unique as a product? What is my drug solving that is different?

- What are the characteristics of the market environment into which our drug is launching?

2. Lofty Launch Goal (LLG)

It is imperative for executives to define what launch success means before fleshing out the commercial strategy. Far too often, leaders across the healthcare industry communicate that their #1 goal in launch is to “maximize revenues” or “maximize profits” when communicating to their commercial organizations and investors. But these goals are fundamentally flawed in that they are not measurable. A commercial team should have the ability to know when it has achieved its goals.

Collins and Porras specifically state that companies should define a “Big, Hairy, Audacious Goal” or BHAG that serves as the 10-year or even 30-year measurable goal for the company. They classify BHAGs into four broad categories: target, common-enemy, role-model, and internal-transformation (James C. Collins, 1996). For drug launch planning, Kx recommends developing a goal or set of goals similar to a BHAG, and typically segments these lofty launch goals (LLGs) into three buckets:

- Financial:

- E.g., reach $200M of US revenue by end of Year 2

- E.g., achieve simple payback before 2025

- Competitive

- E.g., become the #2 drug in our indication by Year 3 of launch

- E.g., knock off Competitor X as the #1 drug company in our target indication

- Brand

- E.g., become brand with highest unaided awareness among our target HCPs

- E.g., become the Apple of our target therapeutic category

- E.g., introduce the first premium drug to cash-pay market

3. The Vivid Description of Launch Success

The vivid description of launch success should answer the question, “what would the environment around our drug look like if we achieve our goal and fulfill our purpose”? The answer to this question could include anything related to your first drug, but typical elements may include:

- Market & competitive position

- Paradigm shifts in provider practices

- Quality of relationships with prescribers

- Brand awareness

- Prescriber reach and conversion

- Patient quality of life

- Patient access to your drug

The primary utility of the vivid description is to motivate and inspire the commercial team with something tangible to which they can aspire during the strategic planning phases ahead of launch. Often even more than the LLG, it has the ability to ground the commercial organization in a common, tangible envisioned future of success.

The Launch Purpose (your “north star”) combined with the Lofty Launch Goal and Vivid Description of Success (your “finish line”) together form the holistic Launch Vision to support your commercial and executive teams throughout the pre-launch planning process. With the Launch Vision in place, commercial leadership can pivot to building out the backbone of the first drug launch strategy: the brand plan and ideal operating plan. Read more about our end-to-end launch strategy capabilities in Steps 2 and 3 of this blog series!

How Kx Advisors can support you in building your first drug’s “Launch Vision”

The “Launch Vision” stage of first drug launch planning is typically executed internally by commercial and executive leadership. However, Kx Advisors’ pharmaceutical launch excellence team supports clients during this initial phase by facilitating workshops and discussions with senior leadership, providing relevant in-market and out-of-market insights from decades of launch strategy experience, and much more. To learn more about Kx’s launch planning capabilities, contact Chris at chris.waybill@kxadvisors.com.

References

Deloitte. (2020, March 26). Key factors to improve drug launches. Retrieved from Deloitte Insights: https://www2.deloitte.com/us/en/insights/industry/life-sciences/successful-drug-launch-strategy.html

James C. Collins, J. I. (1996). INNOVATING TO BRING IMPORTANT NEW THERAPIES TO PATIENTS. Harvard Business Review, 65-77.

Joseph A DiMasi 1, H. G. (2016, March 21). Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics, 1. Retrieved from Policy & Medicine: https://www.policymed.com/2014/12/a-tough-road-cost-to-develop-one-new-drug-is-26-billion-approval-rate-for-drugs-entering-clinical-de.html#:~:text=Developing%20a%20new%20prescription%20medicine,the%20Journal%20of%20Health%20Economics.

Pfizer. (2020, December 02). Pfizer and BioNTech Achieve First Authorization in the World for a Vaccine to Combat COVID-19. Retrieved from Pfizer: https://www.pfizer.com/news/press-release/press-release-detail/pfizer-and-biontech-achieve-first-authorization-world

Pfizer. (2022). INNOVATING TO BRING IMPORTANT NEW THERAPIES TO PATIENTS. Retrieved from Pfizer: https://www.pfizer.com/science/research-development/breakthroughs